Atradius Reports Continued Strong Contributions Across the Group

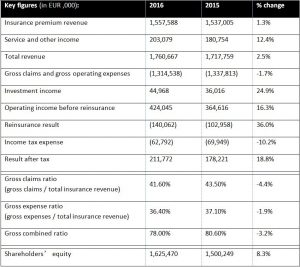

- Total income increased by 3% (3.3% at constant foreign exchange rates)

- Gross insurance result improved 15.5% to EUR 370.4 million

- Investment result rose 24.9% to EUR 45.0 million

- Net profit increased 18.8% to EUR 211.8 million

- Shareholders’ equity increased 8.4% to EUR 1,625.5 million

Atradius’ aim is to lead our customers into the future by strengthening their credit and cash management to support growth of their businesses. We continue investing in new technologies and taking advantage of opportunities in the markets. Our strategy is anchored by our distribution network of brokers and agents who deliver quality services that make a difference and where our people and global footprint play a key role.

Isidoro Unda, Chairman of the Management Board of Atradius commented, “2016 was another strong year for Atradius. We were successful in making improvements to our operations to the benefit of our cost structure and also enabling us to further enhance our operational efficiency and effectiveness. Year after year we are committed to delivering our customers and business partners quality service, regularly updated buyer information, collections support and prompt reimbursement of claims. This resulted in a very high customer retention rate of 93%.”

Outlook

There is a significant amount of uncertainty in 2017 for the outlook of global and regional trade. The expected renegotiation of numerous trade agreements across the world could potentially stall international trade growth. A side effect of this could be an increase in payment defaults as trade costs are expected to rise, putting pressure on some businesses to improve cash management. This should also increase the need for information and collections services to better monitor creditworthiness of buyers and collect overdue debts.

Source: Atradius Earnings Release