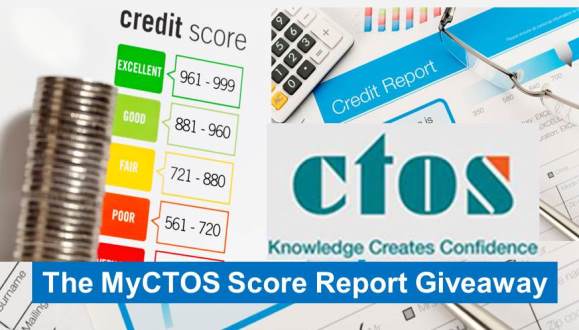

100,000 Free MyCTOS Score Report Giveaway to kick start education and empowerment campaign

100,000 Free MyCTOS Score Report Giveaway to kick start education and empowerment campaign

CTOS Data Systems Sdn Bhd, Malaysia introduced the ‘What’s Your CTOS Score?’ initiative, a first-of-its-kind education campaign targeted at consumers of every life stage. Aimed at transforming the mind-set and attitude of Malaysians towards responsible credit management, the campaign is in response to the Government’s call for Malaysians to improve their credit and financial management skills. As of May 2016, Malaysia’s household debt stood at RM1.03 trillion or 89.1% of gross domestic product (GDP), amongst the highest in Asia[1].

The most popular credit facilities accessed by Malaysians include car loans (40%), home loans (21%), personal loans (19%), credit card loans (15%) and student loans (4%)[2]. Of all the life stages, debt levels especially amongst young Malaysians are of key concern, given that 61.5% of young Malaysians feel that they do not have sufficient skills to manage their finances[3]. Reliance on high cost borrowing methods such as personal loans and credit cards, coupled with ineffective credit management, has resulted in many young Malaysians remaining in an unhealthy cycle of debt.

“Understanding credit management is one of the basic components for good financial health, and must be inculcated regardless of age, gender, education or income. This process begins with obtaining a credit score which evaluates an individual’s creditworthiness and approach to fulfilling debt or payment obligations,” said Eric Chin, Chief Executive Officer of CTOS Data Systems Sdn Bhd.

“Understanding credit management is one of the basic components for good financial health, and must be inculcated regardless of age, gender, education or income. This process begins with obtaining a credit score which evaluates an individual’s creditworthiness and approach to fulfilling debt or payment obligations,” said Eric Chin, Chief Executive Officer of CTOS Data Systems Sdn Bhd.

Eric added, “Through the ‘What’s Your CTOS Score?’ campaign we want to spread the message that a well-managed credit profile is instrumental in helping individuals attain their life goals and still remain financially sound. The campaign is focused on aspects of education and empowerment, to encourage consumers to take charge of their own credit health and be rewarded with preferential offers from our strategic partners.”

The ‘What’s Your CTOS Score?’ campaign kicks off on 1 November 2016 where 100,000 MyCTOS Score Reports worth RM25 each will be given away for free. Each comprehensive report provides details on identity verification, business exposure, credit repayment behaviour, legal actions, case statuses as well bankruptcy information for the past 24 months. MyCTOS Score Report is available through www.ctoscredit.com.my or via the CTOS mobile app for Apple and Android devices. Individuals can also sign up and get their report at any of the 7 CTOS branches nationwide. For those who would like to learn more at their own pace, they can also visit the newly revamped CTOS website where questions pertaining to credit scores and credit management from a Malaysian context are answered through a ‘Credit Check Column’.

Chin added, “Knowing and understanding your MyCTOS Score is not only important for credit management, it is also a tool for individuals to protect against identity theft and fraudulent transactions. The ‘What’s Your CTOS Score?’ campaign also emphasises the importance for individuals to regularly update and maintain their credit reports even if they do not intend to obtain a loan. This way, individuals can keep abreast of their financial positions and always be armed with accurate information should they intend to seek financing in the future”

In conjunction with the ‘What’s Your CTOS Score?’ campaign launch, CTOS introduced its first strategic partner, Alliance Bank Malaysia Berhad. Eligible consumers who obtain a good CTOS Score on their MyCTOS Score report will immediately enjoy:

- Better Fixed Deposit/Term Deposit-i rate at 3.70% p.a. for 3 months placement (minimum deposit amount of RM25,000) with Alliance Bank

- Rates from as low as 4.99% flat p.a. with Alliance CashFirst Personal Loan Up to RM200 Cash Voucher when they spend at least three times (of up to RM1,600) for new Alliance Bank credit card members

- 0% Balance Transfer for up to 12-Month plan with minimum transfer amount of RM3,000

About CTOS Data Systems Sdn Bhd

CTOS, Malaysia’s largest private credit reporting agency, is a registered Credit Reporting Agency under the Credit Reporting Agencies Act 2010. Established in 1990, CTOS has over 25 years of experience in aiding credit grantors make better credit decisions. CTOS utilises information from its users and the public domain to support informed decisions and facilitate fact-based risk management when providing credit extension. CTOS delivers a complete portfolio of credit reports and value-added services and is widely used by the country’s banking and financial institutions, insurance companies, large corporations, legal firms, businesses and state and statutory bodies.

For more information, visit www.ctoscredit.com.my

For more information, visit www.ctoscredit.com.my