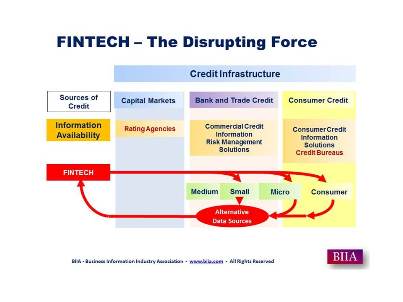

FINTECH the disrupting force in lending and credit information

FINTECH the disrupting force in lending and credit information

FINTECH, it stands for financial technology, is a new interesting concept – its all about lending without having to use a credit bureau and being outside banking regulations. A large amount of capital is already flowing into this sector. It has yet to be seen whether the performance data of FINTECH loans will be available for credit bureaus.

FINTECH is also shifting the way money changes hands, making it easier than ever to make transactions between two entities. It claims to be an alternative route to Financial Inclusion for businesses and individuals.

Below are the top FinTech companies which may make a difference today:

Avoka—Avoka prides itself as a “frictionless” digital sales and service enablement platform. Founded in 2002 for enterprise partner Adobe, Avoka’s main focus is helping businesses whose transactions include things like applying for a loan or credit card, submitting an insurance claim, or opening an account.

Bill.com—A digital payment platform, Bill.com simply unites businesses with banks and accountants with accounts receivable and accounts payable solutions, cutting your process time.

BillGuard—This mobile app is a smart way to track your spending and protect yourself against fraud. You can see how and where you are spending your money, safeguard yourself from suspicious charges, and BillGuard even searches for and alerts you to coupons for things you purchase often.

Circle—A free, instant, secure way to send currency transactions to friends and family using bitcoin. It’s insured, easy to use, and of course, since it uses bitcoin as an arbitrage mechanism, it’s using the future of money to level the playing field and reduce arbitrage.

CoinBase—They consider themselves your “bitcoin wallet.” You can easily buy and sell bitcoin through their marketplace, store it, and use it with merchants who accept bitcoin. You can even send it to friends and family.

Credit Karma—Staying on top of your credit score will have a big impact on your financial future. Sites like Credit Karma are allowing consumers to not only view but understand their credit scores, and work toward a higher score so they can receive better interest rates and keep more of their money.

GoCardless—This is the UK’s answer to PayPal. It’s simple online direct debit, focused for small businesses that deal with a lot of recurring payments. It’s starting to become more and more expensive to take those transaction fees to transfer money, and GoCardless’s aim is to help businesses that simply can’t afford to pay those fees.

Jumio —Jumio allows small businesses to scan cards real-time and check for fraud. Using this identity-management system reduces fraud for businesses and increases conversions for businesses in the travel and gaming sectors.

Kabbage—This site touts itself as the “No. 1 Online Provider of Small Business Loans.” Evaluating real life data, such as your accounting data, Kabbage will approve a business instantly if it meets specific standards. They’ve funded over $550 million thus far, and help small businesses get working capital instantly when they’re in a crunch.

Kreditech—Based in Germany, Kreditech defies the traditional banking methodology. They’re a 24/7 lender that uses proprietary algorithms to lend to individuals within seconds. Rather than using 300 data points to make lending decisions, Kreditech uses 20,000 data points to determine creditworthiness, and the score changes as data changes. Anyone in lending knows traditional credit scores are going the way of the dinosaur. Kreditech is the future.

nTrust—This Canada-based company allows you to pay from anywhere on a mobile device, to anyone. It’s “cloud money,” and you can pay bills by phone or through an nTrust debit card.

OnDeck—OnDeck has delivered $1.7 billion in small business loans worldwide. For small businesses looking at cash flow, OnDeck reduces the paperwork and gets you cash in as little as as one business day, for those lean months when you need to make payroll fast.

Prosper—Peer-to-peer lending networks are becoming more popular, and Prosper is the leader when it comes to social lending. Their loans offer fixed rates that vary from around 6 percent all the way to 35 percent.

Skrill—Shop online a lot? Afraid a hacker might steal your personal payment details? It’s possible that they’ll steal them from your computer, or from the site you’re purchasing from. Skrill’s mission to create a secure payment platform for both customers and businesses.

Square—This tiny piece of hardware has been changing the face of credit card processing for the past few years. Small businesses now have the power to make a sale anywhere by simply plugging a credit card swiper into their smartphone and charging their customer at the point of sale–whether it’s at a brick and mortar location, a swap meet, or in the middle of a festival.

Stripe—Specifically for developers, Stripe built an application program interface (API) to allow companies like Lyft and Instacart to have seamless transactions from customer to business. A huge problem for developers is having a payment solution that’s easy, with a simple, trusted, and secure system, and Stripe aimed at solving that business problem.

TransferWise—Transferring money abroad is expensive, and sometimes not very timely. TransferWise can save you up to 90 percent by eliminating all those hidden bank fees. The service is so popular among ex-pats and world travelers that evenRichard Branson has invested.

Trulioo—With the widest coverage in the market, Trulioo’s instant identity verification service, GlobalGateway, powers fraud and compliance systems to help payment providers and money services businesses adhere to international Anti-Money Laundering (AML) and Know Your Customer (KYC) rules through a single API.

Venmo—Venmo allows for peer-to-peer payments over a mobile phone. If you don’t already have this app for instant payments to a friend after drinks, a meal, or a crazy night out, then you must have no friends.

WePay—An API for developers, WePay allows sites and apps like Care.com, Meetup, and GoFundMe to receive payments easily from customers. It’s a flexible platform that also allows for third-party payments with the host site as the go-between.

Xapo—Owners of bitcoin have the problem that it’s a virtual currency, therefore it can be hacked and needs a secure storage solution. Xapo provides a unique offering–offline encrypted servers for cold storage of bitcoin.

Xoom—Sending money to over 32 different countries around the world has never been easier. Xoom is secure and it tracks updates. It even offers Touch ID for mobile transfers.

Not to forget there is ZEST. The company claims that by using “big data” records sourced from individuals’ social network and internet footprints, typical credit scores can end up 40 per cent higher.

The above data was sourced by: Due.com

Trackbacks/Pingbacks