To improve the bank supervision, protection of creditors’ and depositors’ interests, to get more reliable information on financial situation of the borrower and on the value of the collateral, the Federal Law as of 03.07.2016 №362-FZ “On Introducing Amendments to the articles 72 and 73 of the Federal Law “On the Central Bank of the Russian Federation (the Bank of Russia)” and the article 33 of the Federal Law “On Banks and Banking Activities” was enacted.

To improve the bank supervision, protection of creditors’ and depositors’ interests, to get more reliable information on financial situation of the borrower and on the value of the collateral, the Federal Law as of 03.07.2016 №362-FZ “On Introducing Amendments to the articles 72 and 73 of the Federal Law “On the Central Bank of the Russian Federation (the Bank of Russia)” and the article 33 of the Federal Law “On Banks and Banking Activities” was enacted.

The present law stipulates the procedure performed by the Bank of Russia on availability verification and evaluation as concerns the property being the pledged object (collateral) upon bank loan granting. The Bank of Russia is also entitled to be familiarized with activities of the borrower and the pledger.

The Bank of Russia is entitled to carry out an expert examination of the pledged object, accepted as loan collateral, in order to determine the sufficiency of credit organization risk reserves. This examination includes the implementation of measures to ascertain the pledged object availability (existence), to inspect it and assess its value.

Credit organizations are obliged to set up their reserves taking into account the results of such examination. The ways of providing assistance with obtaining of information on the pledged object and the borrower’s activity should be described in the internal documents of credit organizations.

The information received upon the inspection of the pledged object and during familiarization with the borrower’s or the pledger’s activity may be made public in future only with consent of the informant. The Bank of Russia is responsible for disclosure of such information, including compensation of actual damage.

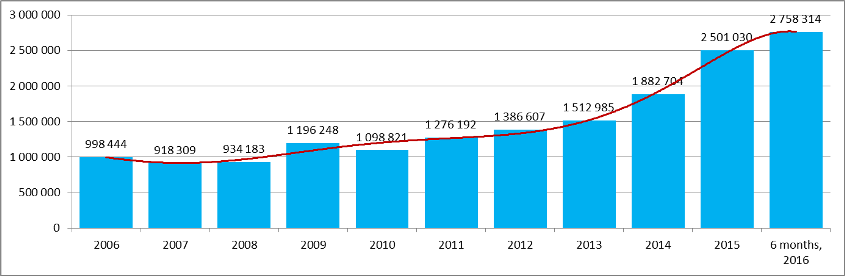

The growing volumes of liabilities of the Russian companies in recent years particularly as concerns debt arising from bank loans testify in favor of relevance of the measures taken to raise the pledgers’ and borrowers’ responsibility to the credit organizations (Figure 1).

Figure 1. Average monthly past due total debts (accounts payable, debts arising of bank credits), source: the Federal State Statistics Service, million RUB

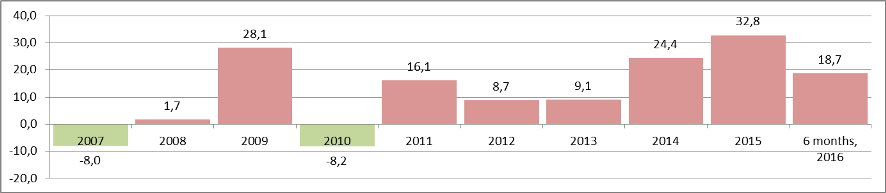

The growth rates of debts (since 2007) are presented on the Figure 2.

Figure 2. Growth/reduction of average monthly past due total debt (accounts payable, debts arising from bank credits), source: the Federal State Statistics Service, % from year to year.

Source: Credinform Russia