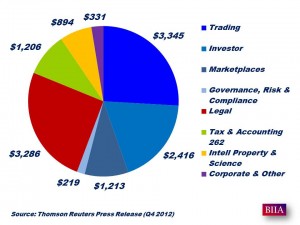

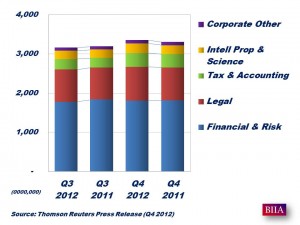

The company reported full-year revenues from ongoing businesses of $12.9 billion, a 3% increase before currency. Adjusted EBITDA increased 5% from the prior year and the corresponding margin was 27.4% versus 26.4% in 2011. Underlying operating profit decreased 5% and the corresponding margin was 18.6% versus 19.9% in the prior year.

The company reported full-year revenues from ongoing businesses of $12.9 billion, a 3% increase before currency. Adjusted EBITDA increased 5% from the prior year and the corresponding margin was 27.4% versus 26.4% in 2011. Underlying operating profit decreased 5% and the corresponding margin was 18.6% versus 19.9% in the prior year.

For the fourth quarter, the company reported revenues from ongoing businesses of $3.4 billion, a 2% increase before currency. Adjusted EBITDA margin of 28.2% and underlying operating profit margin of % were both up versus the fourth quarter of 2011.

For the fourth quarter, the company reported revenues from ongoing businesses of $3.4 billion, a 2% increase before currency. Adjusted EBITDA margin of 28.2% and underlying operating profit margin of % were both up versus the fourth quarter of 2011.

Full-year adjusted earnings per share (EPS) were $2.12, up $0.16 from the prior year while fourth-quarter adjusted EPS was $0.60, up $0.06 from the prior-year period.

“2012 was a watershed year for us,” said James C. Smith, chief executive officer of Thomson Reuters. “First and foremost, we achieved our targets for the full year for revenues, profit and free cash flow. Given the headwinds we faced in 2012, that performance reaffirmed just how strong this business really is.” “2012 will best be known as the year we turned the tide in our Financial & Risk business. I said last year that our journey would entail a multi-quarter turnaround; we are halfway through that process. We laid the groundwork for future success with solid improvements in product quality, customer service and execution capabilities.” “We enter 2013 with more confidence and a much stronger foundation.”

Source: Thomson Reuters Press Release