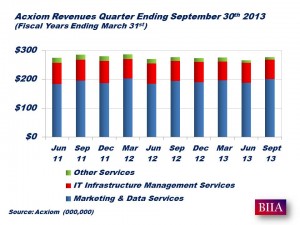

Acxiom revenues were $276 million, down slightly compared to $277 million for the prior-year period. Income from operations decreased to $20 million in the current quarter, compared to $30 million in the prior year. Excluding unusual items, operating income for the quarter decreased 7 percent to $28 million as compared to $30 million in the prior year. Operating cash flow was $170 million for the trailing twelve months, down 4 percent compared to $176 million for the comparable period a year ago. Free cash flow to equity was $69 million for the trailing twelve-month period, compared to $159 million for the comparable period.

“We are at an inflection point and starting the next chapter in our journey,” said Acxiom CEO Scott Howe.“ We are a new company. Over the past two years we have worked to build a better business and to drive innovation. While it’s early, we are pleased with our launch of the Acxiom Audience Operating System and the resulting customer reaction and support.”

Segment Results:

Marketing & Data Services: Revenue for the second quarter increased slightly to $201 million, as compared to $199 million for the same period a year ago. U.S. revenue of $173 million increased 2 percent compared to $170 million in the prior period. Income from operations for the second quarter was $16 million, compared to $22 million in the prior period. Operating margin was 8 percent, compared to 11 percent in the previous year.

Marketing & Data Services: Revenue for the second quarter increased slightly to $201 million, as compared to $199 million for the same period a year ago. U.S. revenue of $173 million increased 2 percent compared to $170 million in the prior period. Income from operations for the second quarter was $16 million, compared to $22 million in the prior period. Operating margin was 8 percent, compared to 11 percent in the previous year.

IT Infrastructure Development: Revenue for the second quarter decreased 5 percent to $67 million, compared to $70 million for the same period a year ago. Income from operations for the quarter was $12 million compared to $9 million in the comparable period. Operating margin was approximately 18 percent, compared to 12 percent.

Other Services: Revenues were US$ 8 million down from US$ 9 million.

Source: mmsbusinesswire.com