Drop in Consumer Mortgage Originations and Corporate Budget Cuts Pummeled the Credit and Risk Solution Segments, while Volatile Markets and Globalization Drove Growth in the Financial Information and Tax & Accounting Segments

Drop in Consumer Mortgage Originations and Corporate Budget Cuts Pummeled the Credit and Risk Solution Segments, while Volatile Markets and Globalization Drove Growth in the Financial Information and Tax & Accounting Segments

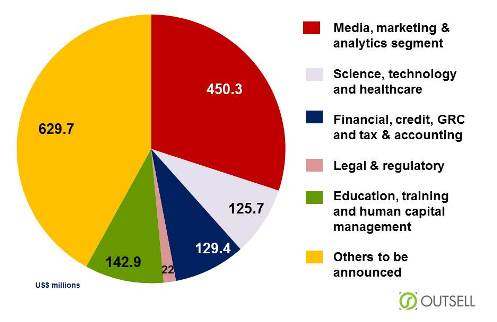

Outsell, Inc., the world’s only research and advisory firm focused on the $1.5+ trillion information industry, announced publication of a new report, 2016 Financial, Credit, GRC, and Tax & Accounting Market. The 2015 market size of this segment is US$ 129.4bn.

This report details the size, shares, trends, and forecasts of the market (as well as each of the respective segments), as part of our annual update to show growth patterns and share shifts. Moreover, it provides advice and essential actions for solutions providers that want to increase revenue opportunities, attract new buyers, address geopolitical impacts (such as those of Brexit), and achieve competitive advantage. Equally, it supports those who cover and need greater understanding of the subject market, including its suppliers, investors, as well as analysts and journalists. Key providers in this market include Bloomberg LP, Experian (EXPN), Verisk Analytics (VRSK), and PwC.

This market consist of financial, credit, governance, risk & compliance (GRC), and tax & accounting information and solution providers. The quest for information visibility, transaction compliance, and data security have brought these four market segments closer together through a common set of tools, while fueling healthy competition through innovation. More importantly, the stakeholders in the financial, credit, GRC, and tax & accounting market will need to challenge themselves to think differently, change existing business processes to ensure survival and growth, and brace for disruption.

William Jan, VP & Lead Analyst at Outsell, states, “Today’s disruptive technologies are no longer being developed by industry-specific companies, but rather by industry-agnostic innovators. Alibaba and Baidu, two of China’s Internet giants, are now both playing in the financial analytics space, as with IBM, whose Watson AI platform is challenging the traditional way of making financial decisions. On the other hand, blockchain is slated to be the next big thing since the Internet, companies not only need to understand what it is, but how they will play in its ecosystem. The earlier this assessment is done, the better. No  one thought the Internet was going to affect them when it first came out, and look at what it has done for the world, today.

one thought the Internet was going to affect them when it first came out, and look at what it has done for the world, today.

Source: Outsell Press Release