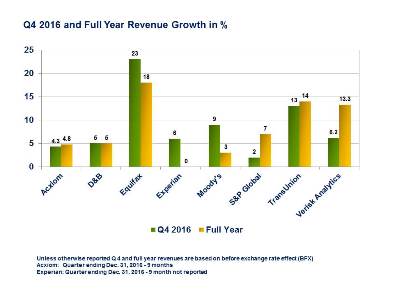

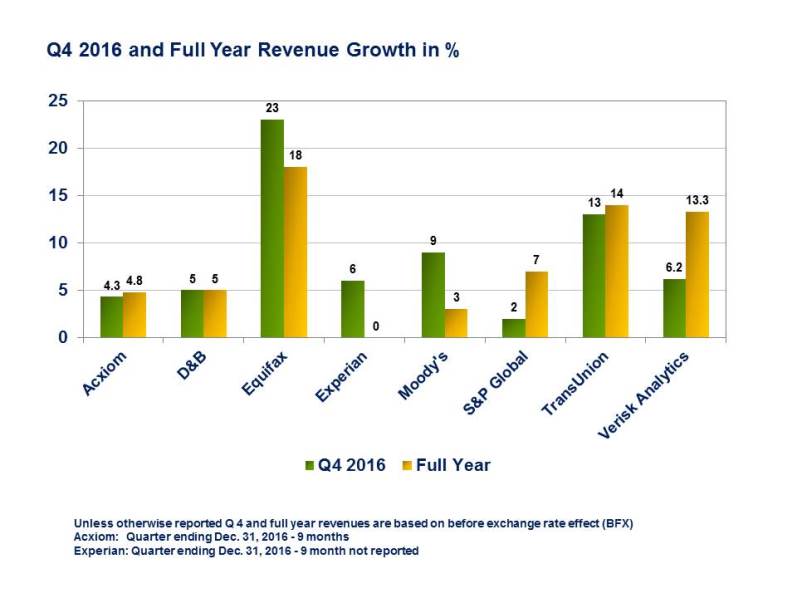

It is the annual report season and BIIA has captured below the segment results of some of the most prominent information providers who had released their earnings up to February 25, 2017. BIIA publishes company results on a regular basis, complete with charts, however the reports are password protected. We are offering this review as an encouragement for our readers to obtain a password (provided their companies are members).

Marketing Services: Revenue was $101 million, down 13% compared to the third quarter of last year. Marketing Database and Strategy & Analytics revenue grew 1% year-over-year. Audience Solutions: Revenue was $83 million, up 8% compared to the prior year.

Connectivity: Revenue, which includes the Arbor and Circulate acquisitions, was $39 million, up 36% compared to the third quarter of last year. LiveRamp™ product revenue grew 61% year-over-year.

Dun & Bradstreet:

Risk management solutions: Q4 total revenue was US$ 271million up 3% (BFX): Within risk management solutions, Trade Credit was 175million down 2% and other Enterprise Risk Management was US$96.4 up 14%.

Sale and Marketing Solutions (S&MS): Q4 total revenue was US$245million up 7% (BFX). Within S&MS, traditional prospecting solutions revenue was US$44million, down 8%; advanced marketing solutions revenue was up US201million up 11%.

Equifax:

Equifax broke through the US$3 billion revenue ceiling with a revenue growth of 18%. The company reported revenue of $801.1 million in the fourth quarter of 2016, a 20 percent increase from the fourth quarter of 2015 and a 23 percent increase in local currency.

USIS total revenue was $316.2 million in the fourth quarter of 2016 an increase of 7 percent from the fourth quarter of 2015.

International total revenue was $212.4 million in the fourth quarter of 2016, up 49 percent from the fourth quarter of 2015 and a 62 percent increase on a local currency basis.

Workforce Solutions total revenue was $173.6 million in the fourth quarter of 2016, a 21 percent increase from the fourth quarter of 2015.

Global Consumer Solutions revenue was $98.9 million, an 18 percent increase from the fourth quarter of 2015 and up 20 percent on a local currency basis.

Moody’s:

Global revenue for Moody’s Investors Service (MIS) for the fourth quarter of 2016 was $607.8 million, up 12% from the prior-year period. U.S. revenue was $375.6 million, up 11%, while non-U.S. revenue was $232.2 million, up 13%. The impact of foreign currency translation on MIS revenue was negligible.

Global revenue for Moody’s Analytics (MA) for the fourth quarter of 2016 was $334.3 million, up 4% from the fourth quarter of 2015. U.S. revenue was $158.3 million, up 11%, while non-U.S. revenue was $176.0 million, down 1%. Foreign currency translation unfavorably impacted MA revenue by 4%.

S&P Global:

Ratings: 4th Quarter, 2016: Revenue increased 14% to $658 million. Transaction revenue increased 26% to $311 million during the quarter primarily due to improved contract terms, increased bank loan ratings, and strength in issuance in structured, U.S. public finance, and corporate markets. Non-transaction revenue increased 5% to $347 million in the fourth quarter primarily due to growth in surveillance fees, an increased intersegment royalty from Market and Commodities Intelligence, and growth at CRISIL.

Market and Commodities Intelligence 4th Quarter, 2016: Revenue decreased 11% to $595 million in the fourth quarter of 2016 due to the sale of J.D. Power, the SPSE/CMA pricing businesses, and Equity and Fund Research. Excluding revenue from these divestitures, organic revenue growth was 8%.

S&P Dow Jones Indices LLC 4th Quarter, 2016: Revenue increased 13% to $171 million in the fourth quarter of 2016. Revenue increased primarily due to AUM growth in ETFs, data subscriptions, and derivatives trading activity. Average AUM in exchange-traded funds based on S&P DJI’s indices was $954 billion in the quarter, an increase of 19% versus the fourth quarter of 2015. By year-end, AUM surpassed $1 trillion, marking a new milestone for the business.

TransUnion:

U.S. Information Services (USIS): USIS revenue was $268 million, an increase of 15 percent. Within this segment Online Data Services revenue was $170 million, an increase of 16 percent. Marketing Services revenue was $45 million, an increase of 7 percent. Decision Services revenue was $53 million, an increase of 18 percent over the prior year.

International revenue was $86 million, an increase of 24 percent (23 percent on a constant currency basis) compared with the fourth quarter of 2015. Acquisitions accounted for a 10 percent increase in revenue. Within this segment developed markets revenue was $29 million, an increase of 14 percent (15 percent on a constant currency basis). Emerging markets revenue was $57 million, an increase of 29 percent (28 percent on a constant currency basis) over the prior year. Acquisitions accounted for a 16 percent increase in revenue.

Verisk Analytics:

Decision Analytics segment revenue from continuing operations grew 6.5% in the fourth quarter and 18.5% for the full year. Decision Analytics organic constant currency revenue growth was 7.3% in the quarter and 6.3% for the full year. Risk Assessment segment revenue grew 5.1% in the quarter and 5.2% for the full year. During the year of 2016 and two months into 2017 Verisk acquired 7 companies in the decision analytics space.