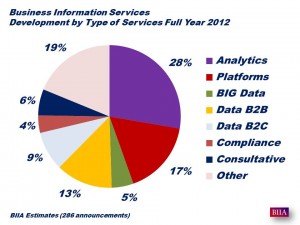

Analytics, Platforms, Software & Workflow plus Big Data continue to remain the driving forces in business information accounting for 50% of business development activities in 2012 (see charts).

Analytics, Platforms, Software & Workflow plus Big Data continue to remain the driving forces in business information accounting for 50% of business development activities in 2012 (see charts).

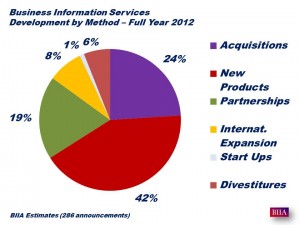

Acquisitions accounted for 24% of announcements. In credit information there were two billion dollar deals in 2012. Experian acquired a remaining stake in Serasa for US$ 1.5 bn. Equifax paid US$ 1 billion for the consumer credit information services of CSC Corporation. There were many small-sized tuck-under acquisitions of unique datasets and of software companies providing analytical capabilities.

In-house product development accounted for 42% of announcements. Companies announced new portfolio management tools, market & risk analytics, risk management platforms, fraud and identity theft solutions and compliance tools. For example Thomson Reuters Governance, Risk and Compliance Unit and D&B is moving into compliance solutions.

Partnerships are becoming more popular for the purpose of gaining access to new data sources or new customer segments, for example the recent partnership between Panjiva and ThomasNet. International expansion is indeed a must for many companies; the method being either go-it-alone, or through partnerships with local firms.

BIIA observed a growing interest in consultative services to provide specific expertise for clients. Under the category of ‘other’ we noted quite a number of announcements on mobile applications, indices and exhibits.

Source: BIIA analysis of 286 company announcement during the year of 2012