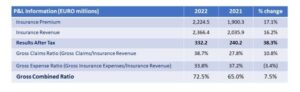

Atradius reports EUR 332.2 million result for 2022. Total revenue grows 16.2% to EUR 2.4 billion.

Atradius N.V. announced a profit of EUR 332.2 million in 2022, a notable increase from EUR 240.2 million in 2021. Insurance premium grew by 17.1%, as a result of strong customer retention and increased levels of insured business. This reflects the strong demand for Atradius’ product offer and service quality.

The combined ratio of claims and expenses over insurance revenue increased to 72.5% following higher claims payments and prudent provisioning. Further improvements to operational efficiency are reflected in the expense ratio decreasing to 33.8%. Against the background of a very difficult geopolitical and economic environment where high inflation and sharply increasing interest rates are driving an increase in insolvencies and many customers are experiencing considerable stress in their supply chains, Atradius’ performance is seen as a reflection of the successful combination of strong focus on customer service, state-of-the-art risk management and operational efficiency.

Financial highlights

- Total revenue reached EUR 2.4 billion, with insurance premium increasing by 17.1%.

- Result for the year of EUR 332.2 million.

- Gross combined ratio 72.5%.

- Insurance and service result of EUR 414.8 million, increased by 37.1%.

- Solid solvency ratio exceeds 200%. (1)

Customer retention of 93.5%, demonstrating customer confidence in Atradius and a steady demand for Atradius’ services.

1). Subject to finalisation of any audit procedures

Insurance revenue

Atradius’ insurance premium revenue increased by 17.1% to EUR 2,224.5 million in 2022 from EUR 1,900.3 million in 2021, reflecting an increase in insurable business volumes following the post-pandemic recovery of trade activity in most markets.

Claims

The claims ratio for 2022 increased to 38.7%. Claims have been steadily increasing through 2022, although still below the 2019 level. Insolvencies have started to sharply increase in some major markets, as a result of high inflation, the delayed impact of government support mechanisms having been withdrawn and a weaker economic outlook.

Expenses

The expense ratio decreased to 33.8% which is 3.4 percentage points lower than 2021. This improvement is a result of leveraging all opportunities for enhanced operational efficiency without compromising on our best-in-class customer service.

Investment result

Atradius’ conservative investment portfolio contributed EUR 42.3 million, with notable contributions from our associated companies and also from our own investment portfolio.

Result after tax

The result after tax increased by 38.3% to EUR 332.2 million from EUR 240.2 million thanks to favourable effects of organic growth, strong demand for Atradius’ products and services and the impact of inflation on insured business volumes.

Solvency ratio

The Atradius solvency ratio exceeded 200% (1) at the end of 2022. This was bolstered by profitable growth in the business, stable investment returns and prudent risk underwriting,

(1) Subject to finalisation of any audit procedures.

(1) Subject to finalisation of any audit procedures.

Source: Atradius Earnings Release