Further weakness in business conditions is expected for the three-month period to 30 September 2016. According to Dun & Bradstreet’s June Business Expectations Survey, expectations for Sales and Selling Prices have plunged to their lowest levels since 2014, while the outlook for Capital Investment is showing signs of recovery.

The survey pre-dates the ‘Brexit’ vote and Australian Federal election which can only be expected to damage relatively fragile business confidence.

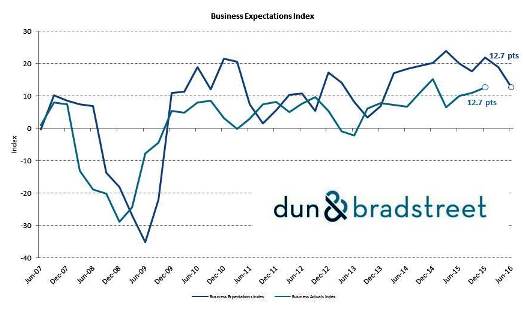

Dun & Bradstreet’s Business Expectations Index, the average of the survey’s measures of Sales, Profits, Employment and Capital Investment, has consolidated at 12.3 points for the third quarter of 2016, compared to 12.7 points for Q2 2016, and down from 17.6 points in Q3 2015. The figure is 5.0 points above the 10-year average of 7.3 points.

Dun & Bradstreet’s Business Expectations Index, the average of the survey’s measures of Sales, Profits, Employment and Capital Investment, has consolidated at 12.3 points for the third quarter of 2016, compared to 12.7 points for Q2 2016, and down from 17.6 points in Q3 2015. The figure is 5.0 points above the 10-year average of 7.3 points.

The Actuals Index halved to 6.1 points from 12.7 points last quarter, and brought an end to three consecutive quarters of growth. The Actual Employment Index plummeted to 2.3 points – its lowest level since late-2013, with the Construction and Retail sectors reporting more decreases than increases in staff numbers. Both sectors maintain a weak outlook for the quarter ahead.

According to Stephen Koukoulas, Economic Advisor to Dun & Bradstreet: “The slide in business expectations over the past year appears to have been arrested in the most recent survey. It should be noted that the survey was conducted prior to the shock Brexit vote, so the results must be treated with caution.”

Koukoulas also observed “there were some mildly encouraging signs, with expectations for capital expenditure edging up from the recent low point. There were, worryingly, signs of further weakness in expected sales and selling prices, the latter of which points to ongoing low inflation.”

To request the full report please contact:

James Malkin

Marketing Manager

479 St Kilda Road

Melbourne 3004

Direct +61 3 9828 3273

malkinj@dnb.com.au