Australian Company profit expectations have reached their highest level since 2003, with Australian businesses anticipating a jump in takings in the New Year on the back of stronger sales and firming selling prices.

Continuing initial positive forecasts for the lead-up to Christmas, Dun & Bradstreet’s Business Expectations Survey shows that 36 per cent of companies expect to increase their earnings during Q1 2014.

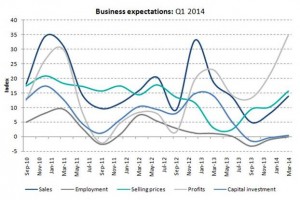

This response has taken the survey’s profits index to a 10-year high of 34.9 points, up from 21.1 in the previous quarter and 22.9 at the same time last year. After remaining downbeat through much of 2013, the business outlook appears to have turned a corner, with profit and sales expectations lifting for consecutive quarters while employment and investment intentions have stabilized.

The sales expectations index for the first quarter of the New Year has risen to 13.9 points, its highest level in 12-months, with 16 per cent of businesses anticipating increased activity while just two per cent expect weaker trade. Further supporting healthier profit margins, 18 per cent of businesses plan to raise the prices of their goods and services in Q1 2014, compared to just two per cent that will discount. This result has taken D&B’s selling prices index up to 15.6 points, its highest level since mid-2012. With official figures showing that the underlying rate of inflation increased at an annual rate of 2.8 per cent in the September quarter this year, which was above expectations, policymakers will be watchful for future gains in the selling prices index.

D&B’s Business Expectations Survey has found that only eight per cent of companies intend to access new finance to grow their operations; an indication that the defensive approach adopted by many businesses this year still prevails. These findings follow official numbers from the Reserve Bank of Australia that show September business credit fell by 0.1 per cent.

With businesses still focusing on core operations over expansion, D&B’s survey has found that investment plans are low and relatively unchanged from the previous quarter. D&B’s capital investment index has moved marginally from -0.4 points to 0.5 points, with just one per cent of businesses intending to increase spending. Meanwhile, despite lifting slightly, the employment index is -0.1 points for Q1 2014, its third consecutive quarter below zero as only two per cent of executives plan to hire new staff.

In further evidence that caution remains despite an improving business outlook, businesses are split on whether 2014 will be a more prosperous than 2013. While 36 per cent of businesses are more optimistic about growth, the same percentage is less optimistic, with 28 per cent of respondents undecided. The issues most expected to impact growth in 2014 are operating costs, online trading of competitors and unpaid invoices.

To read the full report, please click on this link: DB Business Expectations Survey – Q1 2014 – prelim