The results from Dun & Bradstreet’s February Business Expectations Survey have highlighted a sharp decline in expectations for the second quarter, with businesses issuing gloomy forecasts for the three-month period to June 2016.

The results from Dun & Bradstreet’s February Business Expectations Survey have highlighted a sharp decline in expectations for the second quarter, with businesses issuing gloomy forecasts for the three-month period to June 2016.

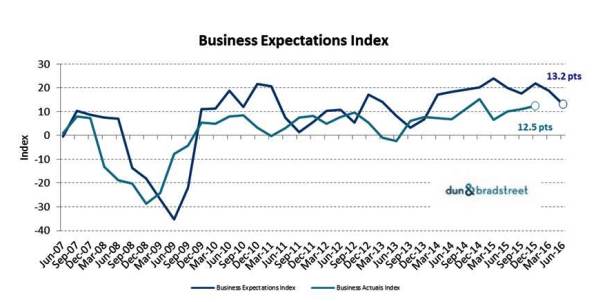

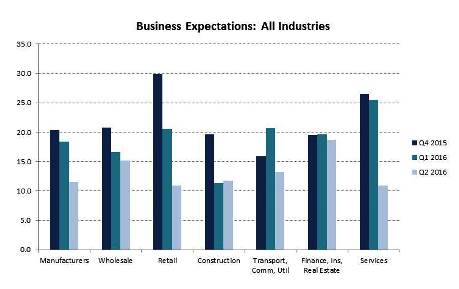

Dun & Bradstreet’s Business Expectations Index, the average of the survey’s measures of Sales, Profits, Employment and Capital Investment, has fallen to 13.2 points for the second quarter of 2016, down 5.7 points from 18.9 points for Q1 2016, and a fall of 6.9 points from 20.1 points for Q2 2015. Nonetheless, it is significantly higher than the 10-year average of 7.0 points. According to Stephen Koukoulas, Economic Advisor to Dun & Bradstreet, “the slippage in business expectations is across the board with expected sales, profits, employment and new capital expenditure slipping to their lowest level in around two years. It is likely that the global financial market ructions in the early part of 2016 and now the policy uncertainty associated with the upcoming election could be dampening the spirits for the business sector.”

Dun & Bradstreet’s Business Expectations Index, the average of the survey’s measures of Sales, Profits, Employment and Capital Investment, has fallen to 13.2 points for the second quarter of 2016, down 5.7 points from 18.9 points for Q1 2016, and a fall of 6.9 points from 20.1 points for Q2 2015. Nonetheless, it is significantly higher than the 10-year average of 7.0 points. According to Stephen Koukoulas, Economic Advisor to Dun & Bradstreet, “the slippage in business expectations is across the board with expected sales, profits, employment and new capital expenditure slipping to their lowest level in around two years. It is likely that the global financial market ructions in the early part of 2016 and now the policy uncertainty associated with the upcoming election could be dampening the spirits for the business sector.”

In particular, the Profit Expectations Index, which plunged to 11.8 points, is at its lowest point since late 2012. Sales (25.4 points) and Employment (7.7 points) expectations also fell significantly, dropping to lows not seen since 2013, while the Capital Investment Index fell to a single digit figure (7.8 points) for the first time in more than two years. The only increase was seen in the Selling Prices Index, which rose 0.3 points to 15.5 points.

“The softening in expectations is not yet a concern for the economy. Interest rates are at historical lows, there are clear signs of a turn-around in commodity prices which if sustained, should be a positive for the economy, and the Australian dollar remains at a level which is boosting the competitiveness of the export sector.

“The softening in expectations is not yet a concern for the economy. Interest rates are at historical lows, there are clear signs of a turn-around in commodity prices which if sustained, should be a positive for the economy, and the Australian dollar remains at a level which is boosting the competitiveness of the export sector.

“Of course, any further slippage in expectations in the months ahead would spark concerns about the growth momentum in the economy, so the next few surveys will be of vital importance”, Mr Koukoulas noted.

Head of Group Development for Dun & Bradstreet, Adam Siddique, was similarly circumspect on the softening results.

“Our view of the economic fundamentals remains sufficiently sound such that we aren’t ringing the alarm bells yet, however, several recent high profile corporate administrations and profit downgrades appear to be weighing on business sentiment leading into the end-of-financial year.”

“Supporting this is the closure of the gap we have previously recorded between business expectations and actual results, suggesting businesses have an increasingly accurate grasp of forecast trading conditions and their underlying impact on activity,” Mr Siddique added.

To obtain further details contact:

| James Malkin | Stephen Koukoulas |

| MalkinJ@dnb.com.au | Stephen@thekouk.com |

| +61 3 9828 3273 | +61 467 647 508 |