Financial stress was heightened during April and is set to worsen in the next three months as slow wages growth, high household debt and costs of living impact consumers’ capacity to manage their finances.

Financial stress was heightened during April and is set to worsen in the next three months as slow wages growth, high household debt and costs of living impact consumers’ capacity to manage their finances.

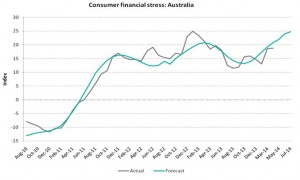

After improving through the second half of 2013 as record-low interest rates and a focus on savings improved the financial position of Australians, Dun & Bradstreet’s Consumer Financial Stress Index has risen from 13 points in January to 18.7 points in April.

By July the index is forecast to hit 24.8 points, the second highest level in its four-year history, as consumers find it more difficult to make their finance repayments and the quality of credit applications deteriorates.

With household income and sentiment expected to be impacted by the Federal Budget, and first quarter figures from the ABS showing that wages grew at a moderate 0.7 per cent, the credit bureau anticipates its stress forecast will trend in a higher range as the year progresses.

“The upward trajectory in the index is concerning, given the number of otherwise improving signals we’re seeing from the economy,” said Gareth Jones, CEO of Dun & Bradstreet – Australia & New Zealand.

“Over the past months businesses have been reporting more positive expectations for sales and profits, and the jobs market has surprised on the upside – however the financial position of consumers forms a significant piece of the recovery puzzle.”

“Given the potential for the budget to weaken already shaky consumer confidence, in addition to soft wages growth and World Bank findings that we’re living in the most expensive G20 nation, it wouldn’t be a surprise to see the financial position of consumers come under more strain,” Mr Jones added.

“Given the potential for the budget to weaken already shaky consumer confidence, in addition to soft wages growth and World Bank findings that we’re living in the most expensive G20 nation, it wouldn’t be a surprise to see the financial position of consumers come under more strain,” Mr Jones added.

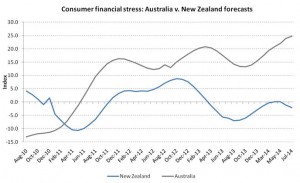

After rising steeply from late 2010, when Australia experienced a delayed economic impact from the global financial crisis, the Consumer Financial Stress Index has remained at an elevated level. In contrast, New Zealand’s stress index has been improving through the year and has returned to negative territory (an index reading below zero indicates lower financial stress, while above zero indicates higher stress).

“The rise in consumer financial stress fits with other recent news including the sharp falls in consumer sentiment, a moderation in house prices and ongoing subdued growth in wages,” said Stephen Koukoulas, Economic Adviser to Dun & Bradstreet.

“The rise in consumer financial stress fits with other recent news including the sharp falls in consumer sentiment, a moderation in house prices and ongoing subdued growth in wages,” said Stephen Koukoulas, Economic Adviser to Dun & Bradstreet.

“It is looming as a genuine threat to the recent strength in spending, if consumers respond to financial difficulty by paring back expenditure.”

“Causes of the rise in consumer financial stress are hard to pinpoint, but appear linked to the still weak growth in household incomes, accelerating credit growth and a still fragile jobs market. While the current low level of interest rates is helping to alleviate consumer financial stress, this is clearly being overwhelmed by other negative factors.”

“The Reserve Bank is unlikely to increase interest rates with consumers on the cusp of scaling back their spending,” Mr Koukoulas noted.

About the index: Dun & Bradstreet’s Consumer Financial Stress Index is an indicative measure of consumer financial stress in Australia. First published in January 2013, the index uses information contained on D&B’s extensive credit databases to measure consumer activity, demand, capacity and confidence. Consumer stress and capacity for financial credit are highly correlated to the broader performance of national economies; with consumer confidence and spending a key driver for small and medium businesses, which constitute more than 95 per cent of all trading businesses in Australia.

To download the document the entire document click on this link: MEDIA RELEASE – Consumer Financial Stress Index – Apr2014