According to the Federal Tax Service of the Russian Federation, the Body registering legal entities, over 11.200 companies were declared bankrupt and dissolved in 2015. It’s is 7,7 per cent higher than in 2014 when about 10.400 legal entities were declared bankrupt and liquidated for the same reason.

According to the Federal Tax Service of the Russian Federation, the Body registering legal entities, over 11.200 companies were declared bankrupt and dissolved in 2015. It’s is 7,7 per cent higher than in 2014 when about 10.400 legal entities were declared bankrupt and liquidated for the same reason.

The main reasons for dissolving in 2015 were as follows: decisions of the registration authority (54 per cent of total number of dissolved companies), reorganization (23 per cent), liquidation (18 per cent), bankruptcies (over 11.200 cases or 3 per cent) and other grounds (2 per cent).

So even in a poor international economic environment, the decrease in GDP, industrial production and consumer demand have not led in Russia to a significant increase in the number of companies who terminated their activity for insolvency reason.

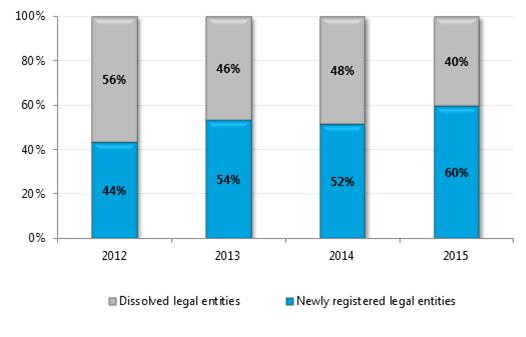

In total for 2015, over 330.000 companies in Russia were dissolved and over 500.000 were newly registered. The ratio of dissolved legal entities to companies established in 2015 is 40% to 60% respectively.

In comparison the situation in 2012 was the opposite: 44% new registrations versus 56% dissolved companies (see the diagram below). During the past three years we observed a rise of registered companies as compared to dissolved companies. This trend indicates a positive business environment in Russia for businesses and for foreign investors.

Diagram: newly registered/dissolved legal entities ratio (total number of established and dissolved companies – 100 per cent)

According to statistical data as of January 2016 there are over 4.800.000 active legal entities registered in Russia – about 4 per cent more than the number in January 2015 (over 4.600.000). Despite all economic challenges the Russian business community remains active and the number of new companies keeps growing.

The most popular Russian regions for registrations are traditionally the following (data on 1 January 2016): Moscow (over 1.100.000 companies and 23 per cent of totally registered companies), Saint Petersburg (over 360.000 companies and 7, 6 per cent) and the Moscow region (over 230.000 companies and 5 per cent).

Last year the Russian business community was shocked by the insolvency of several large companies – who were leaders in their respective industries. These well-reputed companies were mostly engaged in construction (real estate development) and transport (civil aviation) – the sectors mostly affected by the Ruble devaluation and a drop in consumption.

Thus the policy of a rapid expansion and capturing the market in the present economic conditions may no longer work for big business players who had until recently had the reputation of being “reliable”, “successful” and “stable”. What has happened confirms the need to take into account the volatility on the foreign exchange market, to predict the growth or drop in sales and at least but not at last evaluate credit risk and other risks of existing and future business partners?

The Information and Analytical System GLOBAS-i® of Credinform provides the tools to be able to find all necessary information about your business partner/buyer/supplier on-line. Performing fresh investigations on Russian companies Credinform experts verify particularly bankruptcy announcements and search for legally relevant events in official sources.

Monitoring service allows obtaining timely alerts on all changes concerning requested companies including their eventual bankruptcy. Russian legal entities are also assigned a Reliability Index helping to identify fraudulent (“fly-by-night”) companies.

Monitoring service allows obtaining timely alerts on all changes concerning requested companies including their eventual bankruptcy. Russian legal entities are also assigned a Reliability Index helping to identify fraudulent (“fly-by-night”) companies.

Trackbacks/Pingbacks