Dear Members and Friends of BIIA

On this page we publish from time to time additional information in regard to conference themes and panel discussions.

From our events home page you will have noticed that we are covering in this event several key themes:

- Artificial Intelligence: Reality or Hype – The Challenges for the Financial Services Industry and the Likely Consequences for Business/Credit Information

- The Changing Dynamics of Risk Management Information: The availability of data for use in risk management is changing at a rapid pace through the advent of new technology, the changing behavior of consumers, followed by the intervention of regulators

- Financial Inclusion is driven by the need to provide access to finance for individuals, micro and small business. What does SME Financial Inclusion mean and the dilemmas it faces? What will be the way forward: “Credit information is dead, long live ‘financial capability information’!

- Identity has become a major business activity driven by AML, KYC, eKYC compliance requirements. We will hear from information professionals about the opportunities and risks in walking the fine line between transparency and privacy. BIIA has invited compliance professionals to provide a forward looking perspective of their information needs.

- The Future of Credit & Credit Information – Given the almost unprecedented pace of technological change we expect this panel discussion to be rather provocative. Below is further information on this important panel discussion.

There has been a lot of talk recently about the changes which are happening in the credit and credit information ecosystems and what the future will hold.

Our final panel session at the 2019 Biennial BIIA Conference will look to explore these changes and what that means for organizations granting credit and for those supporting these organizations such as credit information companies.

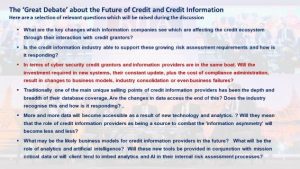

From a credit grantors perspective, whether it is finance from a bank or a supplier, or to a business or individual, we will be asking our esteemed panel of senior information industry executives what are the key changes that they see that are affecting the credit ecosystem through their interaction with credit grantors. It can be argued that granting credit is not just one type of risk assessment anymore. Lenders have not just to assess the risk of repayment but also numerous regulatory and compliance risks and the risk of financial crime. Identification is also a key type of risk assessment as businesses transact with other businesses and individuals more and more in a digital way. Within the context of AML and KYC, compliance forces credit grantors to take a closer look at individuals who are beneficial owners, proxy holders and sole trader, thus business information and information on individuals become intertwined.

Is the credit information industry able to support these growing risk assessment requirements and how is it responding? Will we see new entrants, using new technology and new datasets, offering complimentary (or alternative) services to help lenders meet these growing requirements? How does the credit information industry view these new players? Are they here to stay? If they are what will be there role?

In terms of cyber security credit grantors and information providers are in the same boat. Cyber security has become a serious threat and a game changer to their respective businesses. Regulators are not bashful in imposing huge fines, but also enforce stringent new requirements as to how companies have to manage cyber security and privacy matters. Such requirements have recently been forced on Equifax and Facebook. In regard to the latter the company is required to install a new compliance system, a multi-layered incentive structure of accountability, transparency and oversight. Will the investment required in new systems, their constant update, plus the cost of compliance administration, result in changes to business models, industry consolidation or other more serious consequences?

In terms of cyber security credit grantors and information providers are in the same boat. Cyber security has become a serious threat and a game changer to their respective businesses. Regulators are not bashful in imposing huge fines, but also enforce stringent new requirements as to how companies have to manage cyber security and privacy matters. Such requirements have recently been forced on Equifax and Facebook. In regard to the latter the company is required to install a new compliance system, a multi-layered incentive structure of accountability, transparency and oversight. Will the investment required in new systems, their constant update, plus the cost of compliance administration, result in changes to business models, industry consolidation or other more serious consequences?

One of the main changes in the credit information ecosystem is the availability of data, with more and more data accessible as a result of new technology and analytics. We are seeing more and more initiatives that are ‘freeing’ up data for use in risk assessment – PSD2 in Europe and other open data type initiatives around the world. Are these new data sources a threat or an opportunity for the credit information industry? Will they mean that the role of credit information providers as being a source to combat the ‘information asymmetry’ will become less and less?

Traditionally one of the main unique selling points of credit information providers has been the depth and breadth of their database coverage. Are the changes in data access the end of this? Does the industry recognize this and how is it responding?

Future perspectives: What may be the likely business models for credit information providers in the future? What will be the role of analytics and artificial intelligence? Will these new tools be provided in conjunction with mission critical data or will client tend to imbed analytics and AI in their internal risk assessment processes?

New technology, open data initiatives and the increasing focus on individuals rights regarding privacy and access to data is challenging the traditional data ‘ownership’ model for the credit industry. No longer are credit providers seen as ‘owners’ of the data about a business or individual but more a ‘custodian’. Businesses and individuals are now more aware of the value of their data and we are starting to move to a ‘push’ data model (where the business or individual makes their data available) as opposed to a ‘pull’ model where lenders obtain the data as part of a transaction. How is the credit and credit information industry responding to this? Will their customer be more the ‘end user’ than the ‘intermediary’?

So what is the future for the credit and credit information ecosystem? Register for the conference to hear the views of senior information industry executives and participate in the debate which will follow.

If you would like to add your own questions, please feel free to contact the moderator: Neil Munroe at neilm@crsinsights.com