The advantages to finance departments having quick and easy access to credit ratings and reports are clear, but how can different departments beyond finance use credit information effectively?

There are three disciplines that can leverage company information in online Credit Reports: Sales, Procurement and Marketing. In addition, CEOs and other board level directors are using Credit Reports to monitor acquisition targets and competitors.

The biggest tension between sales and finance is the tendency for sales to sign up prospects in order to meet targets, but without checking whether they could ultimately lead to bad debt. In contrast, finance teams are driven by the need to reduce bad debt and improve profitability. To counter this, sales teams can use online credit reports to check out prospects before signing them up as customers. This may reduce the prospect target list but it also provides a more focused approach that will ultimately lead to fewer bad debts and a stronger financial performance for the whole company; working in harmony with finance.

Procurement Contracts

While it is usually the finance department’s responsibility to set credit limits for suppliers, the experts on potential suppliers of products or services such as IT, can be found elsewhere in the business. However, before making recommendations about who to work with, the procurement team should use credit information for background checks to ensure that they can reduce the risk of working with an unreliable partner and not get caught in a long term supply agreement. Procurement can identify suppliers who are more financially stable, have a strong position within the supply chain and are more likely to deliver. The procurement team should look out for strong credit ratings, boards of directors with unblemished backgrounds and who pay their bills on time. Poor financials and negative supplier performance usually go hand in hand.

Marketing

One of the pressures of operating in a downturn is the need to bring in new business, while continuing to deliver an excellent service to existing customers. Before sending out expensive marketing campaigns to prospects, the marketing team can use credit information to qualify prospects to ensure that they are in a position to pay for products and services. Organizations can sharpen the focus of their marketing plans through using prospect data to identify creditworthy organizations and sectors to target.

Board Level

Having ready access to Credit Reports used by the finance team gives board level directors a tool to use when checking out potential acquisition targets or even competitors. This information can be used as part of the due diligence process or researching a company that has appeared on the scene vying for your customers, a credit report may be able to tell you where they have come from. Anti-Money Laundering, Know Your Customer and Supply chain issues can quickly become board issues. Sourcing internationally requires compliance checks concerning potential supply chain disruptions and employment issues such as bonded labor, underage labor and excessive working hours. Today’s supply chain management goes beyond low cost supply objectives. Not vetting a supplier can potentially become a board room and public relations problem.

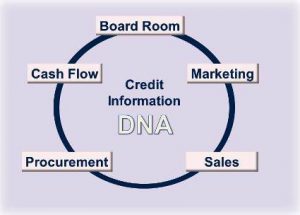

Looking to the future: how will credit information integrate fully into organizational DNA?

Credit information is moving slowly from a standalone tool used in isolation by finance teams to being built into processes and applications undertaken by other commercial teams within the business. Once a company has decided to improve its performance through the wider use of credit information, it needs to think about how to ensure that the whole company buys into the idea. How should this be approached?

- Identify which departments should be involved and where could the biggest improvements be made

- Appoint champions within each department to train on the credit information system and ensure that they understand what they are looking for

- Build credit checking into each relevant process – for example, a new contract cannot be signed by sales until they carry out a check

- Ensure two-way communication between finance and each functional department so that potential risks are reduced

- Measure indicators, such as bad debts and credit notes, over time to identify the ongoing value credit information is bringing to the business

Source: Courtesy of Creditsafe

Source: Courtesy of Creditsafe

BIIA provided certain additions to this blog