As we have covered extensively, regulated businesses face mounting pressures in their onboarding of new customers. The changing requirements as dictated by EU and UK law have made processes more expensive, arduous and complex.

As we have covered extensively, regulated businesses face mounting pressures in their onboarding of new customers. The changing requirements as dictated by EU and UK law have made processes more expensive, arduous and complex.

For banks and financial services firms however, the new customer onboarding scenario is only half the story.

Once customers have been successfully onboarded, there is still the requirement for companies to remediate their existing customers as per their Anti-Money Laundering (AML) and Counter Terrorism Financing (CTF) policies.

In this post I will endeavour to outline what customer remediation is; why it is required; how it is currently undertaken, and; an examination of encompass remediate, a new product from encompass, offering the ability to remediate back books of existing customers at speed and in bulk.

Remediation

Remediation applies to all regulated businesses, including banks and financial services firms, law firms and other professional services firms. These regulated businesses must monitor existing customers themselves, with the job of reporting any suspicious activity to the regulator. Businesses identify, verify and screen customers with the ultimate goal of establishing which customers are most at risk of being susceptible to financial crime.

The purpose of remediation is to apply to the back book of existing customers the same high standards of AML/CTF due diligence as applied to newly onboarded customers. This involves checking and refreshing the information held on file about a customer to identify changes which may present a high risk of money laundering or terrorist financing, such as PEPs or corporate beneficial ownership changes. From here it can be established if the person is who they claim to be and if the business relationship can continue.

Risk based assessment continues with remediation

As part of new regulations regulated businesses can no longer use Simplified Due Diligence (SDD) as a matter of course. Instead, they must assess the risk posed by an individual customer and apply a risk based approach. By using a risk based approach, businesses can make an assessment on each individual customer, and apply a level of due diligence required for the individual customer.

They key for businesses to remember when they are remediating clients, is that they are assessing the risk posed by the existing customer, not the client itself.

Which businesses are at risk?

All regulated businesses are subject to remediation requirements, and banks and financial service firms are no exception.

Legislation such as the Money Laundering, Terrorist Financing and Transfer of Funds (information on the Payer) Regulations 2017 (MLR17) passed in June of this year mean banks and financial services firms need to have in place well-structured and comprehensive remediation programmes. This has caused businesses to examine their internal processes to ensure they meet requirements. Where they have not, banks and other financial services firms have had to redesign internal AML/CTF policies, and then execute these policies against existing customers. On occasion this has meant huge tranches of existing customer data being checked against new policies, a costly, time consuming and energy sapping use of human capital or expensive technology resource.

An example of this took place within Lloyds Banking Group. In July of this year they announced they were undertaking a remediation programme as they found their policies in relation to those charged for mortgage arrears had not always been applied consistently. This has led to Lloyd’s compensating some customers who had policies applied differently to others. A costly exercise.

How is remediation carried out?

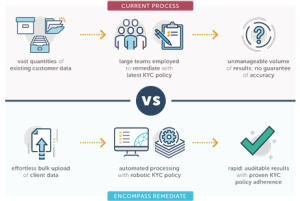

Banks and other financial institutions hold huge amounts of data on existing customers. This will have been collected during the period the customer was onboarded (opened an account or sold a product) and during various remediation processes for customers that have been with them for a substantial length of time.

For many financial institutions, extensive fragmentation of customer data across disparate legacy systems is commonplace.

For many financial institutions, extensive fragmentation of customer data across disparate legacy systems is commonplace. Collating legacy records for existing long standing business relationships is a real challenge; both from a technology and business perspective. Layering on expensive, time consuming and often complex contemporary KYC policy processes to this already difficult task, only acts as yet a further impediment to compliance.

Leveraging modern bulk processing and robotic process automation technology can lessen this burden dramatically.

Introducing encompass remediate

encompass remediate is a new tool within the armoury of the compliance team.

encompass remediate effortlessly conducts KYC policy on existing books of customers to the same high standards of due diligence applied to new business KYC processing. An easy three step guide helps compile, upload and process remediation data using encompass automated KYC policy. Customer profiles are automatically created and remediated with the chosen KYC policy providing assurance of policy and compliance at volume and speed. Encompass remediate delivers faster and cheaper remediation, proven regulatory compliance and safe risk management.

Benefits of encompass remediate:

- consistent compliance: ensure the same KYC standard is applied to existing customers as for newly onboarded customers

- Proven compliance: encompass remediate generates full audit trails and proof documentation which can be shared with auditors and regulators as evidence of compliance

- Save Time and Cost: with effortless bulk processing and automated KYC checking of large volumes of customer data using robotic process automation technology

- remediation management, with automated profile creation and results updates

Remediation for today’s compliance world

As explored above, traditional approaches to remediation are a process, in its current form, that are beset by problems. Following legislation passed at national level and supra-national standards, we know that it must be completed and ignoring this important step in understanding the risk associated with ongoing business relationships is no longer an option. But how? Running manual remediation programmes can be expensive, involving huge amounts of human labour and run counter to other business priorities. With information stored on disparate systems between departments, the collation of such information is a challenge in itself.

As explored above, traditional approaches to remediation are a process, in its current form, that are beset by problems. Following legislation passed at national level and supra-national standards, we know that it must be completed and ignoring this important step in understanding the risk associated with ongoing business relationships is no longer an option. But how? Running manual remediation programmes can be expensive, involving huge amounts of human labour and run counter to other business priorities. With information stored on disparate systems between departments, the collation of such information is a challenge in itself.

Once collated, compliance managers must apply a risk based approach to ascertain the correct level of due diligence to be performed. With information missing, incorrectly filed, or misinterpreted by an individual, the process is ripe for mistakes, omissions and project overruns.

encompass remediate can help. Using the KYC policy already installed within the encompass platform encompass can automate the process, at scale and speed.

Source: encompass Press Release