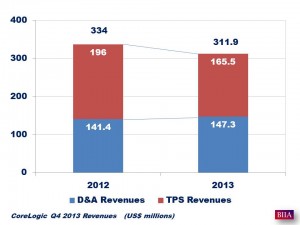

CoreLogic (NYSE:CLGX), a leading residential property information, analytics and data-enabled services provider, today reported revenues for Q4 2013 were down 6.6%. Full year’s revenues are up 7.7%.

Full Year Highlights

- Revenues up 7.7% to $1,330.6 million — growth in Data & Analytics (D&A) and Technology and Processing Solutions (TPS) more than offset the impact of an estimated 20% decline in mortgage market volumes.

- Operating income from continuing operations of $172.9 million, up 1.7%.

- Net income from continuing operations of $130.2 million, up 43.3%. Diluted EPS from continuing operations up 54.0% to $1.34 per share. Adjusted EPS up 11.9% to $1.60 per share.

- Adjusted EBITDA of $389.7 million; adjusted EBITDA margin of 29.3%.

Fourth-Quarter Highlights

- Revenues down 6.6% to $311.9 million — impact of estimated 50% decline in mortgage market volumes partially offset by growth in D&A and TPS market share gains.

- Operating income from continuing operations down 53.2% to $21.6 million.

- Net income from continuing operations of $26.2 million, up 72.5%. Diluted EPS from continuing operations up 86.7% to $0.28 per share. Adjusted EPS down 39.5% to $0.23 per share.

- Adjusted EBITDA of $70.5 million; adjusted EBITDA margin of 22.6%.

“CoreLogic had another strong year in 2013. We delivered revenue and earnings growth despite an estimated 20% drop in loan origination volumes. Importantly for the future, we continued to build-out and enhance our D&A and TPS segments in line with our strategic business plan,” said Anand Nallathambi, President and Chief Executive Officer of CoreLogic. “Over the balance of 2014, we will continue to invest in areas of strategic growth and operational excellence which we believe will provide sustainable, long-term value creation for our stakeholders. Despite significantly lower origination volumes for the second consecutive year, we expect to continue to make progress toward our imperatives of growing our D&A segment to over 50% of our total revenues and ensuring that our TPS operations are positioned to outperform their respective markets.”

“CoreLogic had another strong year in 2013. We delivered revenue and earnings growth despite an estimated 20% drop in loan origination volumes. Importantly for the future, we continued to build-out and enhance our D&A and TPS segments in line with our strategic business plan,” said Anand Nallathambi, President and Chief Executive Officer of CoreLogic. “Over the balance of 2014, we will continue to invest in areas of strategic growth and operational excellence which we believe will provide sustainable, long-term value creation for our stakeholders. Despite significantly lower origination volumes for the second consecutive year, we expect to continue to make progress toward our imperatives of growing our D&A segment to over 50% of our total revenues and ensuring that our TPS operations are positioned to outperform their respective markets.”

“We are exiting 2013 a stronger and more focused company — uniquely positioned to capitalize on our competitive strengths in data and analytics, payment processing and data-enabled services,” added Frank Martell, Chief Financial Officer of CoreLogic. “We believe the actions taken in the past 30 months to transform CoreLogic have prepared us to successfully navigate a historic reset of the mortgage market in 2014. Our strong margin and cash flow profile provides the financial flexibility to continue to invest in the key pillars of our strategic plan including driving our core growth strategies, improving cost productivity, and returning capital to our shareholders.”

Source: CoreLogic Earnings Report