Emerging markets are coming under severe pressure as the dollar strengthens on global markets. Indonesia, however, is proving surprisingly resilient for a variety of reasons, including long-term factors that should  continue to support the currency says Adrian Ashurst, CEO of Worldbox Business Intelligence.

continue to support the currency says Adrian Ashurst, CEO of Worldbox Business Intelligence.

Emerging economies are reeling from the double whammy of Federal Reserve interest-rate hikes and China’s economic slowdown, according to Bloomberg, as shown here by the recent performance of Asian currencies. Indeed, Asian authorities are burning through foreign reserves at the fastest pace since 2008, to defend exchange rates and cover higher import bills for food and fuel. Apart from Hong Kong and Singapore (which have managed currencies) – and Indonesia – the losses for this year against the dollar are in the 7%-plus range.

Figure 1: Asian currencies crumble as the US dollar surges

Economic factors provide a partial explanation

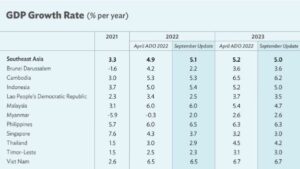

So why is the Indonesian Rupiah (IDR) outperforming neighbouring currencies? Economic fundamentals alone are not the explanation. True, Indonesia is projected to enjoy relatively strong economic growth and low inflation this year and next, particularly in comparison to the advanced economies. But among regional economies, Vietnam, Malaysia and the Philippines are projected to grow at a faster pace than Indonesia this year, while the Philippines and Vietnam are also projected to outpace the country next year, according to the latest Asian Development Bank (ADB) projections.

Figure 1: ASEAN economic growth, 2021-23

Moreover, inflation is likely to prove above the ASEAN average in Indonesia this year, and in line with it during 2023.

Figure 2: ASEAN inflation rates, 2019-23

Source: ADB Outlook, September 2022

Commodity boom drives record export earnings

So, while Indonesia’s economic growth and inflation outlook is strong, it is not particularly remarkable by ASEAN standards and cannot on its own explain the rupiah’s relative resilience. Soaring commodity prices, a credible economic policy framework and political stability are the reinforcing factors.

Indonesia’s resource-rich economy is enjoying record exports, earning huge sums of dollars in the process, driven by the commodities boom. Exports reached an all-time high of USD $27.91 billion in August 2022, rising by over 30% this year due to strong demand and prices for coal and other minerals, as well as palm oil. Consequently, Indonesia enjoyed another comfortable (US$5.76 billion) trade surplus in August 2022, increasing the country’s year-to-date trade surplus to a massive US$34.92 billion.

Figure 3: Indonesia’s trade balance, 2016-22

Twenty-eight consecutive months of trade surpluses have shored up the IDR. The currency has also faced less depreciation than in previous episodes of intense financial market volatility, such as 2018 or early 2020.

The stable IDR has eased pressure on Bank Indonesia (BI) to hike rates aggressively this year, according to ING. [1] The central increased rates by 50bp in September, having hiked by 25bp in August. However, BI Governor Warjiyo said more aggressive rate hikes are not needed. [2]

Supportive policy framework

The governor’s sanguine outlook on inflation partly reflects the country’s fiscal policy. The government is committed to reinstating the 3% budget deficit ceiling, temporarily scrapped during the COVID-19 pandemic, by 2023. The most recent budget – announced in August for fiscal year ‘23 (January to December) – has been well received. The ratings agency Fitch, for example, described plans to reduce the budget deficit to 2.85% of GDP as “credible.” Fitch added that restoration of the deficit cap should support Indonesia’s plans to cease direct monetary financing of the deficit by the end of 2022. [3]

Political stability

Much of the credit for the economic boom is due to President Joko Widodo, according to the Financial Times, [4] which says that he has managed to maintain popularity with both ordinary Indonesians and investors alike after eight years in power. It cited a poll released in September 2022 by research firm Indikator Politik Indonesia that showed 62.6% of Indonesians approved of the president’s performance, making him one of the world’s most popular democratic leaders.

Those numbers are particularly remarkable given that fuel prices had earlier increased by about 30% across Indonesia after the government reduced some subsidies. Many Indonesians appeared to accept Widodo’s argument that the hike — the first in eight years — was unavoidable given the country’s energy subsidy has tripled this year to 502 trillion rupiah (US$34 billion) from its original budget, due to rising global prices of oil and gas.

The Financial Times added that Widodo would have an opportunity to show off Indonesia’s prosperity to the world when he hosts the Group of 20 summit in Bali in November. The newspaper said the president plans “to use the event to court interest from global investors, including for his most ambitious and controversial plan yet — a more than $30bn proposal to shift Indonesia’s capital from Jakarta to the jungle-clad island of Borneo, a project that could yet define his legacy”.

However, the Financial Times warned that the country’s newfound economic and political stability should not be taken for granted. It pointed out that campaigning for the 2024 election would begin next year and that Widodo (who cannot stand again, having already served two terms) does not yet have an anointed candidate to carry on his agenda. The newspaper cited criticism that the president “could have done more to further embed Indonesia’s young democratic institutions, leaving it vulnerable if a more venal leader comes to power”.

Commodity earnings likely to fall but prospects remain strong

Moreover, economists have warned that Indonesia remains heavily dependent on commodity exports, such as coal and palm oil, which could lose steam next year as the advanced economies slow. The IMF, for example, in its latest World Economic Outlook [5] is forecasting the advanced economies will grow by just 1.4% in 2023, following an expansion of 2.5% in 2023. It is forecasting oil prices would fall by 12.3% in 2023, having risen by 67.3% in 2021, and a projected 50.4% in 2022. That should benefit Indonesia, which has been a net importer of oil since 2004. However, the price of non-oil commodities is forecast to decline by 3.5%, having risen by 26% in 2021 and a projected 10% this year. That could dent export earnings.

Overall, however, the outlook for Indonesia appears brighter than for many years. For one thing, the pressure on the rupiah – and other emerging market currencies could relent in 2023 if, as many analysts believe, the Federal Reserve’s hiking cycle goes into reverse as the US economy slows.

[1] https://think.ing.com/snaps/indonesia-commodity-boost-powers-exports-to-new-high

[2] https://www.bloomberg.com/news/articles/2022-09-22/indonesia-raises-key-rate-more-than-expected-as-rupiah-weakens

[3] https://www.fitchratings.com/research/sovereigns/indonesia-budget-reaffirms-credible-fiscal-consolidation-path-23-08-2022#:~:text=The%20government’s%20projection%20that%20the,budget%20deficit%20ceiling%20by%202023

[4] https://www.ft.com/content/f179df5b-1dc7-46f4-88dc-97ddfe1d2fe4

[5] https://www.imf.org/en/Publications/WEO/Issues/2022/07/26/world-economic-outlook-update-july-2022

About Worldbox Business Intelligence

An independent service, Worldbox Business Intelligence provides online company credit reports, company profiles, company ownership and management reports, legal status and history details, as well as financial and other business information on more than 50 million companies worldwide, covering all emerging and major markets.

Worldbox was founded in the 1980s, with the vision to become a global business provider. Its ability to deliver data in multiple languages in a standard format has strengthened its brand.

Copyright (C) 2022 Worldbox Business Intelligence. All rights reserved.

Our mailing address is:

Worldbox Business Intelligence

Breitackerstrasse 1

Zollikon

Zurich 8702

Switzerland