This is your BIIA recommended weekend reading: If you are interested in what Covid-19 has done to the Fintech industry we recommend that you read this report.

This is your BIIA recommended weekend reading: If you are interested in what Covid-19 has done to the Fintech industry we recommend that you read this report.

The CBInights Report: While deals and dollars to global fintech companies are both down, certain parts of the fintech ecosystem actually stand to benefit long-term from the Covid-19 pandemic.

Mirroring other sectors, fintech activity and investment has been muted through the first five months of 2020. This comes as no surprise, as Covid-19 is keeping the venture landscape broadly in something of a holding pattern. At the same time, the story for fintech is more nuanced. While funding is down and certain sectors are hurting, others actually stand to benefit long-term from the pandemic.

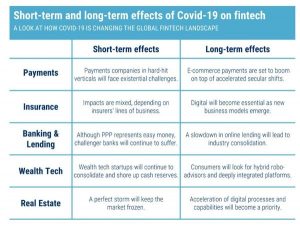

In this brief, CBInsights look at the short-term and long-term effects of Covid-19 on five parts of the fintech ecosystem:

- Payments

- Insurance

- Banking & Lending

- Wealth & Capital Markets

- Real Estate

Here is a short recap of the Payment Sector:

On the one hand, companies serving the restaurant industry are facing existential crises. At the same time, those payments companies serving the e-commerce space are seeing their transaction volumes sharply accelerate.

Short term: some Payments companies will face existential challenges

Payments companies targeting verticals hit hardest by Covid-19 such as travel, restaurants, and events and entertainment, among others, will have to find new sources of transaction volume in order to survive.

Payments companies focused on the restaurant industry are perhaps most at-risk, with merchant acquiring companies here hit particularly hard. These include Toast (which cut 50% of its staff in early April), TouchBistro (which furloughed 20% of its workforce in April), and Square (card present volume down 60% in final 2 weeks of Q1’20).

To reduce risk, these companies have placed bets in other areas, like government-backed loans: TouchBistro tapped Lendio to help it distribute loans to its restaurateurs, while Square is leveraging its Cash App to distribute loans directly to consumers. Both companies are uniquely positioned to distribute loans by leveraging their respective merchants’ historical transaction data.

Long Term: e-commerce payments companies benefit from accelerated shifts in tech and consumer behavior

Even as Covid-19 is wreaking havoc on certain industries, it has caused payments volume to accelerate in other key areas.

Most notably, Covid-19 is contributing to an explosion in e-commerce at the expense of physical retail. This shift is driving transaction volume to the payments companies behind online retailers and taking market share away from those serving physical retailers. This displacement is happening for both consumers and merchants, as merchants begin to turn to online B2B marketplaces for procurement and supplies.

As a result, the biggest long-term beneficiaries of Covid-19 will be payments companies enabling the e-commerce sector. These include players like Stripe, Adyen, PayPal, and Shopify. Indeed, Stripe saw its valuation rise to $36B in a $600M Series G extension in April; Adyen saw a 34% jump in Q1 revenue driven by online payments; and PayPal saw payment volume rise 22% in April after a bumpy March. Finally, Shopify saw gross merchandise value grow 46% in the first quarter, as the company launched a new product “Shop” to help users search across the company’s merchant base.

This theme is clear not only among established companies but earlier stage startups as well. These include players like one-click checkout provider Fast (which raised a $20M Series A in March) and payment-facilitator-as-a-service provider Finix (which raised a $10M Series B extension in March).

This report was created with data from CB Insights’ emerging technology insights platform, which offers clarity into emerging tech and new business strategies through tools like:

- Earnings Transcripts Search Engine & Analytics to get an information edge on competitors’ and incumbents’ strategies

- Patent Analytics to see where innovation is happening next

- Company Mosaic Scores to evaluate startup health, based on our National Science Foundation-backed algorithm

- Business Relationships to quickly see a company’s competitors, partners, and more

- Market Sizing Tools to visualize market growth and spot the next big opportunity

To read the entire report click on this link

Source: Owler

Also read: Indian Fintechs under Stress