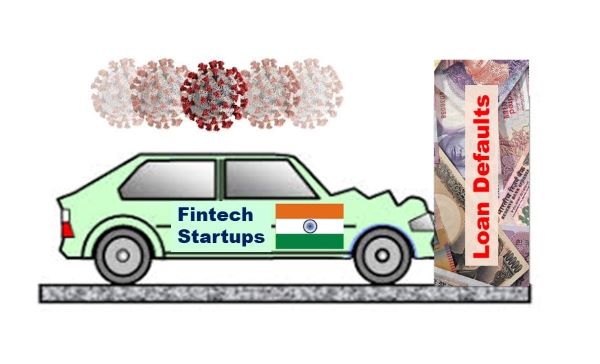

Dismal Loan Recoveries Leave Lending Startups in the Red Zone

With investors unlikely to pump in more capital on the back of dismal loan recoveries, businesses and portfolio managers have already started approaching larger players in the space for a potential deal.

India’s lending technology startups, which have been providing personal loans to blue-collared workers, and unsecured loans to micro, small and medium enterprises, are facing a bleak future, with consolidations and shuttering of operations anticipated across the space, even as they look to survive the Covid-19 pandemic.

A substantial number of fintech lending companies, which also hold non-banking financial company (NBFC) licenses, are expected to take a significant hit to their loans books, as repayment collections slow down, while for others the flow of credit from larger NBFCs and banks grind to a halt.

With investors unlikely to pump in more capital on the back of dismal loan recoveries, businesses and portfolio managers have already started approaching larger players in the space for a potential deal.

“We have already been approached by a few players who have a dire cash position, to acquire them. We expect both the financial services and fintech industries to consolidate,” Bala Parthasarathy, CEO and co-founder of MoneyTap, told ET. MoneyTap has a loan book of Rs 1,400 crore.

“The VCs are mentally prepared for a few companies to go bust. They will prefer companies, where the founder has the ability to, not just save the company, but also be able to raise a new round. VCs are reaching out, and have been scouting for potential M&As, or even aqui-hires,” Jitendra Gupta, chief executive of digital banking startup Jupiter, said.

This comes at a time when the country’s larger shadow banking industry continues to be under pressure post the default by cash-strapped IL&FS in September 2018, followed by the Dewan Housing Finance and Yes Bank crises, which in turn, has forced the central government to step in and manage the crisis.

COVID-19 will be the acid test for many Fintechs. We will find out those who are good technolists as well as good lenders, or just technologist with now expertise in lending (BIIA editorial comment). The latest comment came from Etprime: Many roadblocks have slowed India’s fintech journey of late. The lockdown due to the Covid-19 pandemic may just be the last nail in the coffin.