‘In times of increasing insolvencies, more companies value trade credit insurance as effective management and risk control tools’ ‘Pre-qualification vetting of contractors reduces project disruptions and saves costs for surety bond beneficiaries’

‘In times of increasing insolvencies, more companies value trade credit insurance as effective management and risk control tools’ ‘Pre-qualification vetting of contractors reduces project disruptions and saves costs for surety bond beneficiaries’

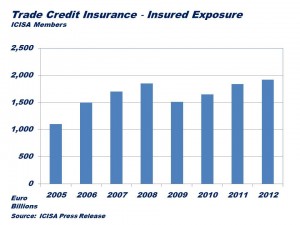

Trade credit insurance insured exposure increased by 4.4% to € 1.92 trillion (2011: € 1.84 trillion)

- Premium increased by 3% to € 6.14 billion (2011: € 5.96 billion)

- Claims paid to clients increased by 12% to € 2.93 billion (2011: € 2.62 billion)

- Insured exposure is at all-time high in spite of high risk environment with growing number of insolvencies

- Increase in claims paid to clients is to a large extent due to insolvencies in Europe

The members of the International Credit Insurance and Surety Association (ICISA) met in Milan for their 71st Annual General Meeting to discuss market and industry developments. Concerns were raised about the slow economic recovery, especially in Europe, as it continues to restrict the willingness of companies to invest and trade. Insolvencies are increasing and consequently a continuing rise in premium levels is reported by the trade credit insurance and surety members.

“In times of increasing insolvencies, more companies value trade credit insurance as effective management and risk control tools. It is evident that it has a positive effect on the cash flow management and business continuity of our members’ clients and is therefore valued as management tool in an environment concerned with an increasing number of bankruptcies”, says ICISA President Jim Davidson. “ICISA trade credit insurance members paid out almost three Billion Euros in claims to clients over 2012. This demonstrates the soundness and financial flexibility of the industry. Policyholders received almost three Billion Euros for their unpaid receivables enabling them to continue trading in spite of these losses”, Andreas Tesch, Vice-President of ICISA, adds.

USA Platform: Members of ICISA decided to increase the regional focus of the Association by creating a USA platform. “The Asia Sub-committee has already proven to be a strong pioneering initiative after its inaugural meeting last year. In order to better assist our trade credit insurance members operating in the USA, it is decided to continue our regional focus by creating this new platform”, AndreasTesch explains.

Source: ICISA Press Release