The members of the International Credit Insurance & Surety Association (ICISA) met in Hamburg for their 72nd Annual General Meeting to share and discuss market and industry developments. The economic environment continuous to improve, but it is acknowledged that there are still risks threatening the recovery, such as lack of adequate SME financing, continued high sovereign debt levels and political unrest in parts of the world. A turn-around in Southern Europe is visible with lower claims and a growing premium income. With ample reinsurance capacity and increasing trade flows, members look positive to the year ahead.

Discussions between members and the business information industry (represented by BIIA) revealed concerns about the availability and reliability of buyer information in some Asian markets.

During the Annual General Meeting the membership elected Andreas Tesch (Atradius) as President for 2014/2015 and Jos Kroon (Nationale Borg) as Vice President for the same period.

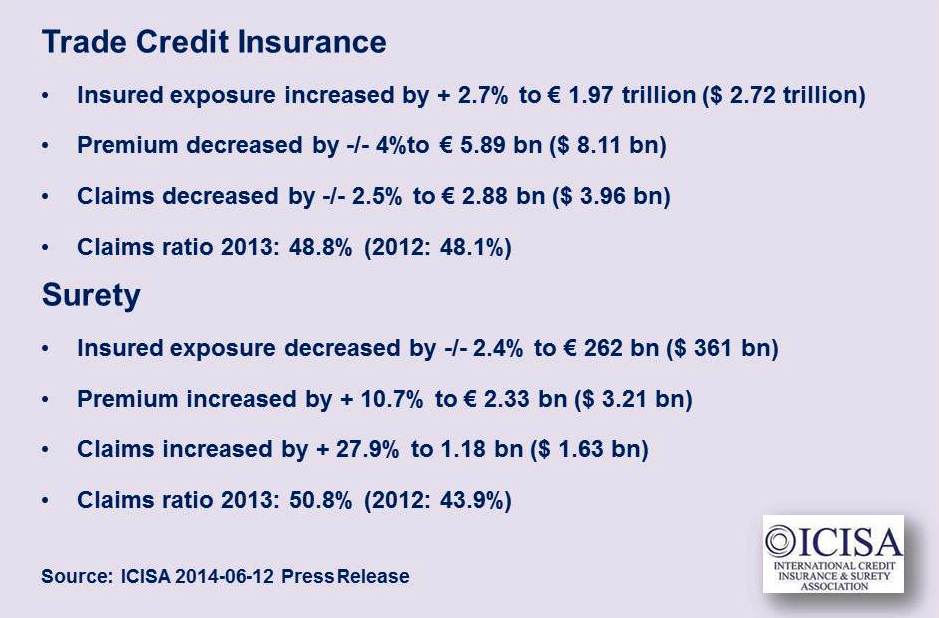

Trade credit insurance: “Insured exposure increased to a record 2 trillion Euro, which is a confirmation of the improved outlook for trade and continuous support of trade credit insurer to their clients”, Andreas Tesch, President of ICISA explains. “Furthermore, the slightly improved insolvency environment is reflected in a stabilised claims ratio in 2013. Ample capacity and increased competition on the other hand had a downward effect on premium income while the introduction of Solvency II in Europe will increase the capital requirement and therefore the need to include this in the pricing structures for credit insurers”, Tesch notes. Comparing the current situation with the pre-crisis (2007) period, Tesch indicates that “members’ results exceed pre-crisis levels, with a 31% higher premium income and 15% higher insured exposure.”

Surety: Despite struggling construction and transportation industries, ICISA surety members saw their income grow by almost 11% to well over 2 billion Euro. The claims, some of them large, have caused the overall claims amount to increase by almost 30%.

“The increased claims figure reflects the aftermath of the crisis, but also demonstrates the ability of sureties to indemnify. It highlights the high risk environment surety customers operate in”, Jos Kroon, Vice President of ICISA explains. “Comparing the 2013 surety results with those from before the crisis (2007), premium income has more than doubled, while the insured exposure grew by more than 45%”, Kroon adds.

The International Credit Insurance & Surety Association (ICISA) brings together the world’s leading companies that provide trade credit insurance and/or surety bonds. Founded in 1928 as the first credit insurance association, ICISA has currently 50 members in total. The trade credit insurance members account for over 95% of the world’s trade credit insurance business. Today, with over USD 2 trillion in trade receivables insured and billions of dollars worth of construction, services and infrastructure guaranteed, ICISA members play a central role in facilitating trade and economic development on all five continents and practically every country in the world.

Source: ICISA Press Release