In the second half of 2022, payment delays at German companies increased to an average of 10.95 days (second half of 2021: 9.97 days). This is the highest value in seven years. Significant cost increases due to the Ukraine war and inflation contributed significantly to this development.

Energy crisis increases failure risks

Lenders and suppliers recorded a noticeable deterioration in payment behavior in Germany. In the second half of 2022, payment delays in B2B business rose to an average of 10.95 days (second half of 2021: 9.97 days). This is the highest value in seven years. “The rise in payment delays comes as the economy slows. That sets off the alarm bells for lenders and creditors,” comments Patrik-Ludwig Hantzsch, Head of Economic Research, on the current data. “The risk of bad debts is higher than it has been for years.” For the study, Creditreform economic research evaluated around four million invoice documents from the Creditreform debtor register Germany (DRD).

Lenders and suppliers recorded a noticeable deterioration in payment behavior in Germany. In the second half of 2022, payment delays in B2B business rose to an average of 10.95 days (second half of 2021: 9.97 days). This is the highest value in seven years. “The rise in payment delays comes as the economy slows. That sets off the alarm bells for lenders and creditors,” comments Patrik-Ludwig Hantzsch, Head of Economic Research, on the current data. “The risk of bad debts is higher than it has been for years.” For the study, Creditreform economic research evaluated around four million invoice documents from the Creditreform debtor register Germany (DRD).

Payment targets already shortened during the Corona period

In the second half of 2022, the mean collection period or outstanding days averaged 40.92 days across all sectors, which was 0.61 days higher than in the previous period (January to June 2022). This key figure shows the time between the time the service is rendered and the time the payment is received. Nevertheless, the collection period, which is made up of the agreed payment target plus the default in payment, was still lower than before the Corona crisis. Many lenders had reduced their payment terms during the crisis in order to minimize the risk of default. On average, customers were granted a payment term of 29.97 days in the second half of 2022. For comparison: At the beginning of the corona pandemic, significantly longer payment terms of around 32 days were common.

“Suppliers and lenders are currently benefiting from their risk-minimised receivables management from the Corona period,” says Patrik-Ludwig Hantzsch. However, massive price increases for energy and other primary products are now weighing on both lenders and borrowers. Due to the worsening of the general conditions, the lenders are forced to adjust the credit conditions again. Nonetheless, defaults are likely to increase.

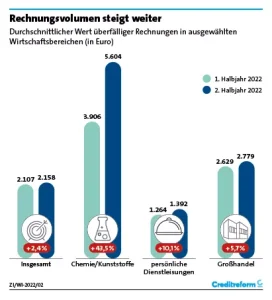

The average value of an invoice paid late increased to EUR 2,158 in the second half of 2022 (first half of 2022: EUR 2,107). During the Corona crisis, there was a decline in transaction volumes. For some time, however, the invoice values have been increasing again, because inflation and price increases are likely to cause the values to continue to rise. “Companies usually do not die in the acute crisis phase, but when business starts up again and then the money is missing,” Hantzsch continues.

Small business focus

Small companies (50 employees or less) caused more than a quarter of all overdue receivables (27.8 percent) in the second half of 2022. Compared to the previous period (first half of 2022), this share has increased by 1.7 percentage points. However, large companies with more than 250 employees were still responsible for most of the defaults at suppliers and lenders. Most recently, however, the proportion of major customers fell to 58.8 percent. “Small companies often pay their bills late, and the bills are increasing. Therefore, focusing solely on major customers is deceptive,” emphasizes DRD manager Janine Stappen. The energy crisis is likely to have a greater impact on small and medium-sized companies and increase their risk of default. Late payments by small firms rose to 12.53 days in H2 2022. On average, large companies paid their invoices 9.91 days late.

Database Creditreform payment indicator Germany:

Payment information for around 1.06 million companies is available in the German Debtor Register (DRD). Payment indicator figures are based on overdue but balanced receipts. A document volume of around 87.6 billion euros for 1,160 sectors is analyzed in Germany. 22 million payment details are currently evaluated every month.

The next “Payment Indicator Germany” will appear in August 2023.

The next “Payment Indicator Germany” will appear in August 2023.

Source: [german language] Creditreform