A new study by CTOS Digital Bhd and Monash University Malaysia School of Business showed that Malaysians’ consumer credit score continues to improve.

According to the CTOS State of Consumers Credit Report for Malaysia 2022, the average CTOS Score among 1.4 million individual CTOS users increased to 678 from 663 over the past three years.

“Despite the pandemic, financial health has managed to hold steady within the range which is viable for credit applications. “Credit card utilisation maintains a rate of around 24 per cent also demonstrates that consumers, in general, did not have to increase unsecured credit spending to survive the difficult period,” the credit reporting agency said in a statement today (24/2/2023).

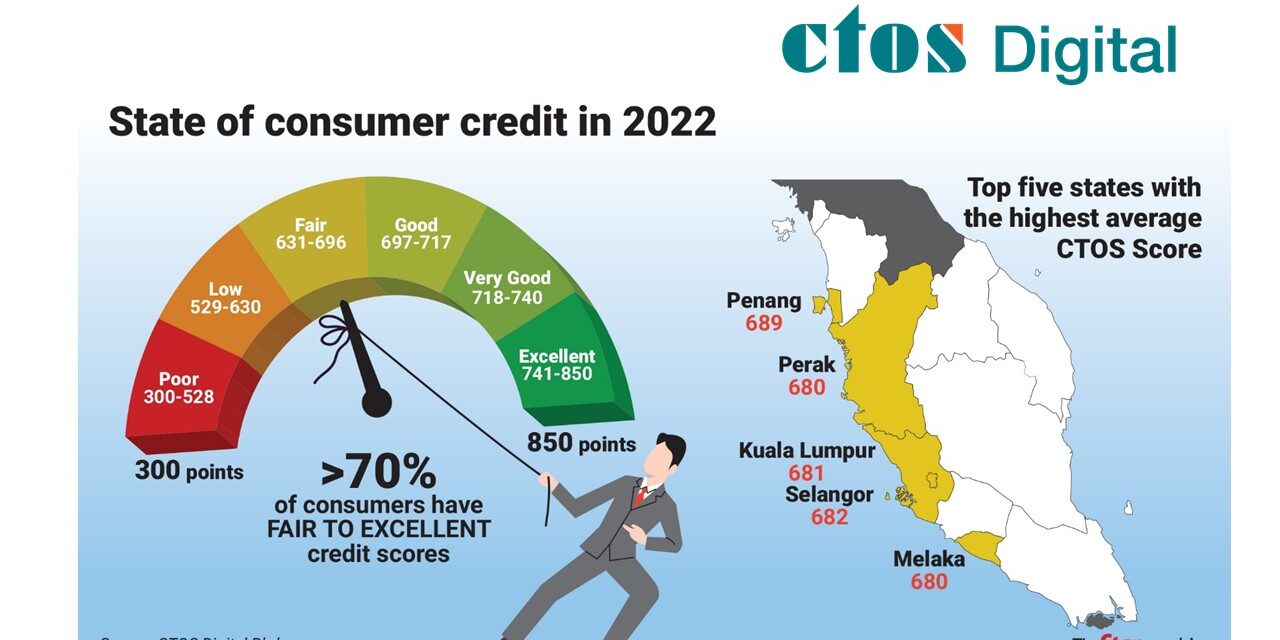

The CTOS Score is a three-digit number representing a consumer’s creditworthiness based on the individual’s payment and management of their credit.

It ranges from 300 to 850. The higher the score, the higher the chances of securing credit.

Also, 28.3 per cent of consumers fall below the ‘fair’ rating, meaning that they will need help obtaining credit from mainstream lenders, putting them at risk of falling prey to illegal lenders that often provide credit with exorbitant interest rates. This means that financial education is still crucial for over a quarter of consumers in Malaysia, while the importance of maintaining financial health is a factor for the remaining population.

Meanwhile, CTOS said that compared with other countries on the global stage, Malaysia still has some way to go compared to the US, which has an average credit score of 716. However, in the Southeast Asian region, credit scores are a relatively new concept.

CTOS said credit bureau penetration is much higher in Malaysia than its neighbours such as Indonesia, where only 20-25 per cent of the population has a credit profile, or Thailand, where a recent study by FICO showed that 67 per cent of Thailand consumers were not satisfied with generic credit offers from their bank, due to lack of credit scoring.

“At CTOS, our mission is to empower individuals and businesses alike to gain access to credit and take control of their financial futures,” group chief executive officer Erick Hamburger said. He said the company has also carried out around 150 financial education programmes with various organisations in the last three years, including the Ministry of Finance, Bank Negara Malaysia, the Credit Counselling and Debt Management Agency (AKPK) and the Employees Provident Fund (EPF). “Through these initiatives, we provide consumers with the opportunity to learn, engage, and strengthen their financial management skills, empowering them to improve

“At CTOS, our mission is to empower individuals and businesses alike to gain access to credit and take control of their financial futures,” group chief executive officer Erick Hamburger said. He said the company has also carried out around 150 financial education programmes with various organisations in the last three years, including the Ministry of Finance, Bank Negara Malaysia, the Credit Counselling and Debt Management Agency (AKPK) and the Employees Provident Fund (EPF). “Through these initiatives, we provide consumers with the opportunity to learn, engage, and strengthen their financial management skills, empowering them to improve  their credit health and personal finances,” he added.

their credit health and personal finances,” he added.

Source: NewStraitsTimes