Wilma Jordan of JEGI (The Jordan, Edmiston Group, Inc.) presented at the recent Outsell Signature event in Versailles, France an annual overview of M&A activities in the Media, Information, Marketing & Technology M&A fields.

Wilma Jordan of JEGI (The Jordan, Edmiston Group, Inc.) presented at the recent Outsell Signature event in Versailles, France an annual overview of M&A activities in the Media, Information, Marketing & Technology M&A fields.

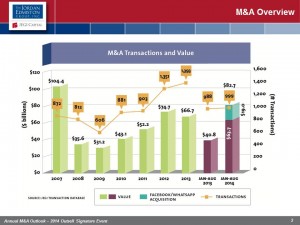

The M&A market is typically a strong economic indicator, and it is also sending out mixed signals. While deal value increased 132% in the first half of 2014 vs. 1H 2013, it was driven by a just a handful of multi-billion dollar deals, such as Facebook’s $19 billion acquisition of WhatsApp. A full 83% of deals were below $50 million in value – a continuing M&A trend that raises questions about the level of confidence which entrepreneurs, corporations and investors have in the current recovery, not to mention their tolerance for risk. Wilma’s view is that corporations and financial investors, while actively exploring acquisitions and sitting on record amounts of cash, are cautious about “pulling the trigger” on larger deals, until a clearer picture of the economy emerges.

The M&A market is typically a strong economic indicator, and it is also sending out mixed signals. While deal value increased 132% in the first half of 2014 vs. 1H 2013, it was driven by a just a handful of multi-billion dollar deals, such as Facebook’s $19 billion acquisition of WhatsApp. A full 83% of deals were below $50 million in value – a continuing M&A trend that raises questions about the level of confidence which entrepreneurs, corporations and investors have in the current recovery, not to mention their tolerance for risk. Wilma’s view is that corporations and financial investors, while actively exploring acquisitions and sitting on record amounts of cash, are cautious about “pulling the trigger” on larger deals, until a clearer picture of the economy emerges.

In regards to Database & Information Services there were 47 deals in 2014 with a total value of 3,114bn, while in 2013 there were 40 deals valuing $3,273bn.

To view the entire presentation click on this link: Courtesy The Jordan, Edmiston Group Inc.