Core revenue for the third quarter of 2012 was $413.2 million, up 2% before the effect of foreign exchange (up 1% after the effect of foreign exchange), as compared to the prior year similar period.

Core revenue for the third quarter of 2012 was $413.2 million, up 2% before the effect of foreign exchange (up 1% after the effect of foreign exchange), as compared to the prior year similar period.

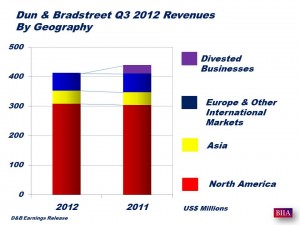

Total revenue for the third quarter of 2012 was $413.2 million, down 5% before the effect of foreign exchange (down 6% after the effect of foreign exchange), as compared to the prior year similar period. Total revenue for the third quarter of 2011 included the results from businesses that were divested or shut down. Deferred revenue was$543.4 million, down 2% from the prior year similar period.

Operating income before non-core gains and charges for the third quarter of 2012 was $127.9 million, up 8% from the prior year similar period, primarily due to reengineering savings as well as the effects of recent business divestitures. On a GAAP basis, operating income for the third quarter of 2012 was $109.7 million, up 9% from the prior year similar period.

“D&B had a solid third quarter despite a difficult environment, and we remain on track to meet our full year guidance,” statedSara Mathew, Chairman and Chief Executive Officer.

Results by Geography:

North America:

- Core and total revenue for the third quarter of 2012 was $308.3 million, up 1% before the effect of foreign exchange (flat after the effect of foreign exchange), as compared to the prior year similar period. Total revenue for the third quarter of 2011 included the results of AllBusiness and Purisma that were divested.

- Operating income for the third quarter of 2012 was $117.3 million, up 5% from the prior year similar period, primarily due to higher total revenue and reengineering savings.

Asia:

- Core revenue for the third quarter of 2012 was $44.8 million, up 9% before the effect of foreign exchange (up 4% after the effect of foreign exchange), as compared to the prior year similar period.

- Total revenue for the third quarter of 2012 was $44.8 million, down 34% before the effect of foreign exchange (down 36% after the effect of foreign exchange), as compared to the prior year similar period. Total revenue for the third quarter of 2011 included the results from our market research business in China and the domestic portion of our Japanese operations that were divested, as well as our Roadway operations in China that were shut down.

- Operating income before non-core gains and charges for the third quarter of 2012 was $6.4 million, up 29% from the prior year similar period, primarily due to the positive impact from the restructuring of our Japan operation where we exited the domestic Japanese market and retained the high margin cross border business.

Europe & Other International Markets

- Core and total revenue for the third quarter of 2012 was $60.1 million, up 3% before the effect of foreign exchange (down 4% after the effect of foreign exchange), as compared to the prior year similar period.

- Operating income for the third quarter of 2012 was $17.3 million, up 12% from the prior year similar period, primarily related to savings from our reengineering efforts, partially offset by the negative impact of foreign exchange.

Full Year 2012 Guidance: D&B reaffirmed its financial guidance for the full year 2012:

- Core revenue growth of 0% to 3%, before the effect of foreign exchange;

- Operating income growth of 4% to 7%, before non-core gains and charges;

- Diluted EPS growth at the high-end of our range of 8% to 11%, before non-core gains and charges; and

- Free cash flow of $275 million to $305 million, excluding the impact of legacy tax matters and any regulatory fees and fines associated with our China operations, and including expenses related to MaxCV (Strategic Technology Investment program).

Source: D&B Press Release