Total revenue for the first quarter of 2013 was $381.0 million, down 5% both before and after the effect of foreign exchange, as compared to the prior year similar period. Total revenue for the first quarter of 2012 included the results from businesses that were divested or shut down.

Total revenue for the first quarter of 2013 was $381.0 million, down 5% both before and after the effect of foreign exchange, as compared to the prior year similar period. Total revenue for the first quarter of 2012 included the results from businesses that were divested or shut down.

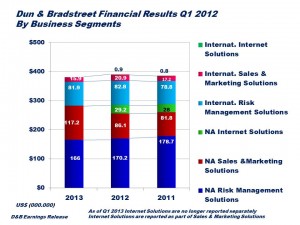

Core revenue for the first quarter of 2013 was $381.0 million, down 1% both (excluding divested businesses) before and after the  effect of foreign exchange, as compared to the prior year similar period:

effect of foreign exchange, as compared to the prior year similar period:

- Risk Management Solutions revenue of $247.9 million, down 2% both before and after the effect of foreign exchange, as compared to the prior year similar period;

- Sales & Marketing Solutions revenue of $133.1 million, up 1% both before and after the effect of foreign exchange, as compared to the prior year similar period.

- Results for the Internet Solutions business are no longer reported separately and are included in Sales & Marketing Solutions.

Operating income before non-core gains and charges for the first quarter of 2013 was $91.8 million, down 13% from the prior year similar period, primarily due to lower total revenue, higher level of investment activity and deployment costs for the new data supply chain.

“Our first quarter results were in line with expectations and we remain confident in our guidance ranges for the year. Looking ahead, we expect our new products and analytics to create additional value for our customers and position the business for a stronger second half” said Sara Mathew, Chairman and Chief Executive Officer. “Early customer feedback on these new solutions is positive, and our team is focused on flawless execution to drive both customer and shareholder value.”

Revenue growth in the second half is expected to come from new products in advanced analytic solutions designed to widen our competitive moat and bring significant new value to customers. Sara Mathew specifically mentioned D&B Delinquency Predictor, the D&B Total Loss Predictor and the D&B Viability Rating.

D&B reaffirmed its financial guidance for the full year 2013: Core revenue growth of 0% to 3%, before the effect of foreign exchange. Operating income decline of 6% to 3%, before non-core gains and charges, including $25 million to $30 million in costs related to the deployment of our new data supply chain. Diluted EPS growth of 8% to 11%, before non-core gains and charges. Free cash flow of $270 million to $300 million, which excludes the impact of legacy tax matters and any potential regulatory fines associated with our China operations.

D&B’s stock rallied following the earnings announcement.

Source: D&B Press Release