About the BIIA 2019 Biennial Conference: It is one of the largest networking events for business information professionals in general and credit information and risk management professionals in particular.

One of the conference themes deals with the increasing importance of managing identity, its challenges and trends – the latest insights from the perspective of a compliance professional. Identity has become a major business activity driven by AML, KYC, eKYC compliance requirements. Thus information professionals should be keen where the current boom will lead to.

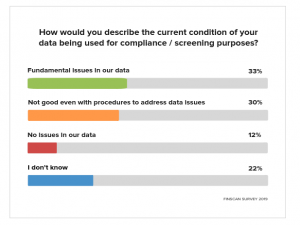

But there appears to be a problem with the underlying data for providing the necessary transparency and confidence in compliance decisions. For information professionals it should be shocking to learn that 63% of compliance professionals reported lacking confidence in their data!

Where? Okura Prestige Hotel in Bangkok, Thailand. When? October 30th to November 1st 2019.

To view the agenda please click here. To register please click here.

Shocking! 63% of compliance professionals reported lacking confidence in their data!

Shocking! 63% of compliance professionals reported lacking confidence in their data!

There are countless ways data can become “bad” data. Whether it is due to siloed data sources across the enterprise, inflexible legacy systems that were not built to interact with modern day technology, lack of budget or resources to clean up years’ worth of inaccurate data entry, or simply human error, poor data quality is at the core of compliance screening problems that anti-money laundering (AML) professionals must deal with daily.

In most organizations, the data that AML departments receive was originally collected and processed for various business purposes other than compliance. Therefore, it’s no wonder that that same data causes numerous issues when brought together for compliance purposes such as sanctions and Politically Exposed Persons (PEP) screening.

Anti-money laundering officers, Bank Secrecy Act (BSA) officers, Money Laundering Reporting Officers (MLROs), and other compliance professionals are undoubtedly aware of problems with their data quality. In fact, according to a 2019 FinScan survey, a whopping 63% of compliance professionals reported lacking confidence in their data. Unfortunately, they may not have any direct influence or control over the quality of their internal data, leaving them powerless to resolve the complex problems that bad data can create.

Empowering compliance officers to control the quality of their data

This abbreviated article discusses key information you need to know about the ticking time bomb of risk caused by bad data and what you can do to defuse the situation. We’re answering essential questions, including:

This abbreviated article discusses key information you need to know about the ticking time bomb of risk caused by bad data and what you can do to defuse the situation. We’re answering essential questions, including:

- How large of a problem is bad data, and how does it impact regulatory compliance?

- How can compliance departments improve their data quality to optimize risk management and compliance efforts?

Understanding the scope of the “bad data” issue

Poor quality data is a major concern for MLROs and AML/BSA compliance professionals everywhere for a number of reasons; however, on a basic level the concerns surrounding data quality can be boiled down to two points: bad data is extremely common, and bad data can have serious consequences.

Innovative Systems has more than 50 years of experience in data management and compliance screening, and over the years, countless AML compliance professionals have shared with us their fears that the poor quality of their data has:

Innovative Systems has more than 50 years of experience in data management and compliance screening, and over the years, countless AML compliance professionals have shared with us their fears that the poor quality of their data has:

- Resulted in too many false positives

- Created the need for unnecessary due diligence and otherwise limited efficiency

- Ultimately created the risk of missing true hits due to these other distractors

False positives are reported as the number one issue across compliance departments. Keep reading to learn how FinScan can help you combat false positives and strengthen your overall efforts to fight against financial crime today.

The weight of all this bad data bogs down the entire AML/KYC screening process. Compliance specialists worldwide are struggling with too many false positives and a high  backlog of alerts, which create regulatory risk and inefficiency.

backlog of alerts, which create regulatory risk and inefficiency.

The traditional approach to AML/KYC screening no longer works

Typically, firms attempt to address these issues by tweaking their matching algorithm, buying the best regulatory list database, and applying new technologies such as artificial intelligence and machine learning. These efforts, however well-intentioned, do not address the root cause of the problem — the bad data itself.

Good data is the foundation of effective AML compliance

Data is the foundation of a firm’s compliance program. If the data is weak, all of these other strategies will yield results just as unsatisfactory as the first attempt. For this reason, addressing data quality is a critical component of the sanctions and PEP screening process. Not only will it save your organization from wasting time and resources by reducing false positives — it will also help you catch true hits you might otherwise miss before they can wreak havoc on your AML compliance.

Bad data can have big consequences

Using clean data for compliance purposes not only increases productivity and minimizes a firm’s risk of doing business with bad actors — it’s also a regulatory requirement.

Consider these excerpted requirements from New York State’s Department of Financial Services Part 504 regarding Transaction Monitoring and Filtering programs:

- Identification of all data sources that contain relevant data

- Validation of the integrity, accuracy and quality of data to ensure that accurate and complete data flows through the Transaction Monitoring and Filtering Program

- Data extraction and loading processes to ensure a complete and accurate transfer of data from its source to automated monitoring and filtering systems, if automated systems are used

Essentially, these regulations require financial institutions to put in place a robust process for screening and proving the quality of their data. Failure to comply with such regulations can result in sanctions breaches that involve public censure, fines, reputational damage, loss of consumer confidence, and even personal accountability.

Further, if your screening system cannot overcome your bad data, it will not bode well for your organization. For example, the US Treasury’s Office of the Comptroller of the Currency (OCC) has issued a Finding of Violation to JPMorgan Chase & Co. (“JPMC”) for violations of the Foreign Narcotics Kingpin Sanctions Regulations.

Excerpt: From approximately 2007 to October 2013, JPMC used a vendor screening system that failed to identify these six customers as potential matches to the SDN List. The system’s screening logic capabilities failed to identify customer names with hyphens, initials, or additional middle or last names as potential matches to similar or identical names on the SDN List.

These types of enforcement actions have historically originated in the US, but new EU and UK sanctions have led to recent increases in compliance enforcement around the world.

When bad data happens to good people

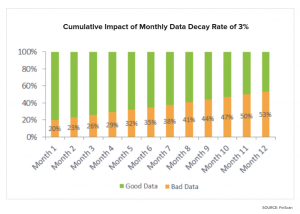

If you’re struggling to maintain high quality data or achieve AML/KYC screening compliance, you are not alone. Many organizations have difficulty keeping their data clean. It’s challenging because data changes all the time. The average rate of data decay in an organization is 3% per month — or 36% per year — which means maintaining data integrity is a constant battle.

Average data error rate can be as high as 50%

Even if an organization has a mechanism to ensure data integrity, at FinScan we have seen many cases where this still is not sufficient to bring the quality of the data to levels that will enable proper compliance with the latest laws and regulations. This is not a surprise given that organizations’ customer databases were built for business purposes other than compliance. Based on numerous assessments FinScan has conducted, we estimate that the average error rate in the data sets we encounter is an incredible 50% before we clean it.

Compliance is not responsible for their organization’s data problems but are impacted by them

The problem is not that compliance professionals are unaware of their poor data quality — it is that they simply do not have the time, resources, or ability to clean up the bad data entries that have accumulated in their systems over many years. The resources in their IT departments are dedicated to managing today’s challenges and pursuing future advancements, not fixing yesterday’s mistakes.

Unfortunately, in many firms, the reality is that the quality of client data is not even close to being good enough to enable an effective, efficient and compliant screening program.

To read the full story click on this Link

Source: Bobsguide.com