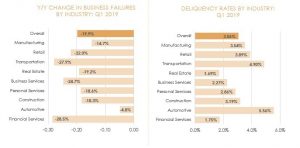

Dun & Bradstreet’s quarterly report tracks payment delinquencies (91+ days past due) and business failures across nine key U.S. industries: Manufacturing, Retail, Transportation, Real Estate, Business Services, Personal Services, Construction, Automotive, and Financial Services. Delinquency rates and bankruptcy rates provide a snapshot of two metrics of overall financial health to facilitate better understanding of benchmark trends, leading to better credit management.

Overall Failures and Delinquencies

The dominant theme in the overall metrics this quarter is the (slight) downturn in payment delinquency rates for the first time in about a year. Reduction in delinquencies in the Construction vertical drove the overall decline with modest contributions from the Retail and Automotive sectors. All other verticals noted minor increases, while Real Estate showed no change from last quarter.

With the Federal Reserve’s campaign of steadily hiking rates on hold since earlier this year, businesses have had some breathing room to manage their payment performance. However, this reprieve might be short-lived owing to the development of protectionist pressures within the country, fueling

the trade wars between United States and China to last longer than expected.

Failures and Delinquencies by Industry: Q1 2019 Trends

Business failures and payment delinquency rates continue to vary by major industries. Overall business failures have declined by about 19.9% since the last quarter. Like last quarter, Automotive continued to register the highest delinquency rate, and also the lowest quarter –over-quarter decline in business failures. The US Automotive sector has seen considerable volatility this year. Early 2019 saw a setback as a result of severe winter weather, and effects of the US federal government shutdown. A brief spurt of recovery in vehicle sales in March 2019 preceded a further decline in April, making it the sector with the highest payment delinquencies.

Business failures and payment delinquency rates continue to vary by major industries. Overall business failures have declined by about 19.9% since the last quarter. Like last quarter, Automotive continued to register the highest delinquency rate, and also the lowest quarter –over-quarter decline in business failures. The US Automotive sector has seen considerable volatility this year. Early 2019 saw a setback as a result of severe winter weather, and effects of the US federal government shutdown. A brief spurt of recovery in vehicle sales in March 2019 preceded a further decline in April, making it the sector with the highest payment delinquencies.

The current low interest rates, low unemployment, and low inflation should continue to reduce delinquencies within most major sectors (specifically those that conduct business with consumer goods), but demand could see a decline if the trade war causes higher prices.

Methodology

Delinquent payment data is compiled from D&B’s global trade database to calculate delinquency rates; Dun & Bradstreet processes more than 1.5 billion trade experiences every year. Business failure data comprises bankruptcy filings in the U.S., as well as businesses that closed their doors with severe outstanding debt relative to their size.

To read the complete Quarterly Industry Delinquency and Failures Report, click on this link: Download Report

Source: Dun & Bradstreet