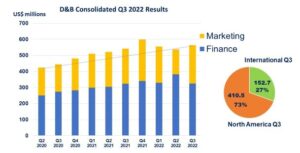

- GAAP Revenue and Adjusted Revenue for the third quarter of 2022 were both $556.3 million. GAAP Revenue and Adjusted Revenue increased 2.7% and 6.6% on a constant currency basis compared to the third quarter of 2021.

- Excluding the impact of acquisitions and divestitures, organic revenue was $562.9 million, an increase of 3.9% on a constant currency basis compared to the third quarter of 2021.

- GAAP net income for the third quarter of 2022 was $8.0 million, or $0.02 diluted earnings per share, compared to net income of $16.6 million or diluted earnings per share of $0.04 for the prior year quarter. Adjusted net income was $123.4 million and adjusted diluted earnings per share was $0.29 for both the third quarter of 2022 and the prior year quarter.

- Adjusted EBITDA for the third quarter of 2022 was $223.0 million, an increase of 1.2% compared to the third quarter of 2021, and adjusted EBITDA margin for the third quarter of 2022 was 40.1%.

“We are pleased to deliver another solid quarter of financial and operational execution at Dun & Bradstreet. Organic constant currency revenue growth of 3.9% during the third quarter was driven by balanced performance across both our North America and International business segments,” said Anthony Jabbour, Dun & Bradstreet Chief Executive Officer. “Our results demonstrate the strength and resilience of our business fundamentals, as we continue to achieve defensible growth despite a challenging macro environment. Overall, I am very pleased with the way we have executed year to date and I believe Dun & Bradstreet is well positioned in the market due to our combination of high quality revenues, increasing innovation, strong margins, solid balance sheet and disciplined capital allocation.”

“We are pleased to deliver another solid quarter of financial and operational execution at Dun & Bradstreet. Organic constant currency revenue growth of 3.9% during the third quarter was driven by balanced performance across both our North America and International business segments,” said Anthony Jabbour, Dun & Bradstreet Chief Executive Officer. “Our results demonstrate the strength and resilience of our business fundamentals, as we continue to achieve defensible growth despite a challenging macro environment. Overall, I am very pleased with the way we have executed year to date and I believe Dun & Bradstreet is well positioned in the market due to our combination of high quality revenues, increasing innovation, strong margins, solid balance sheet and disciplined capital allocation.”

- GAAP Revenue and Adjusted Revenue for the nine months ended September 30, 2022 were both $1,629.6 million. GAAP Revenue increased 4.0% and 6.9% on a constant currency basis compared to the nine months ended September 30, 2021. Adjusted Revenue increased 3.7% and 6.6% on a constant currency basis compared to the nine months ended September 30, 2021.

- Excluding the impact of acquisitions and divestitures, organic revenue was $1,628.4 million, an increase of 4.0% on a constant currency basis compared to the nine months ended September 30, 2021.

- GAAP net loss for the nine months ended September 30, 2022 was $25.1 million, or diluted loss per share of $0.06, compared to net loss of $60.1 million or diluted loss per share of $0.14 for the prior year period. Adjusted net income was $333.2 million, or adjusted diluted earnings per share of $0.78, compared to adjusted net income of $329.2 million, or adjusted diluted earnings per share of $0.77 for the prior year period.

- Adjusted EBITDA for the nine months ended September 30, 2022 was $613.1 million, an increase of 1.4% compared to the nine months ended September 30, 2021, and adjusted EBITDA margin for the nine months ended September 30, 2022 was 37.6%.

Segment Results

North America

For the third quarter of 2022, North America revenue was $403.6 million, an increase of $29.5 million or 7.9% and 8.0% on a constant currency basis compared to the third quarter of 2021. Excluding the impact of acquisitions which contributed revenue of $15.8 million and the negative impact of foreign exchange of $0.4 million, North America organic revenue increased 3.8%.

- Finance and Risk revenue for the third quarter of 2022 was $224.1 million, an increase of $10.1 million or 4.7% and 4.8% on a constant currency basis compared to the third quarter of 2021.

- Sales and Marketing revenue for the third quarter of 2022 was $179.5 million, an increase of $19.4 million or 12.1% and 12.2% on a constant currency basis compared to the third quarter of 2021.

North America adjusted EBITDA for the third quarter of 2022 was $188.4 million, an increase of 1.5%, with adjusted EBITDA margin of 46.7%.

North America adjusted EBITDA for the third quarter of 2022 was $188.4 million, an increase of 1.5%, with adjusted EBITDA margin of 46.7%.

For the nine months ended September 30, 2022, North America revenue was $1,152.2 million, an increase of $81.5 million or 7.6% and 7.7% on a constant currency basis compared to the nine months ended September 30, 2021. Excluding the impact of acquisitions which contributed revenue of $43.4 million and the negative impact of foreign exchange of $0.8 million, North America organic revenue increased 3.6%.

- Finance and Risk revenue for the nine months ended September 30, 2022 was $635.8 million, an increase of $31.6 million or 5.2% and 5.3% on a constant currency basis compared to the nine months ended September 30, 2021.

- Sales and Marketing revenue for the nine months ended September 30, 2022 was $516.4 million, an increase of $49.9 million or 10.7% and 10.8% on a constant currency basis compared to the nine months ended September 30, 2021.

North America adjusted EBITDA for the nine months ended September 30, 2022 was $503.1 million, a decrease of 0.2%, with adjusted EBITDA margin of 43.7%.

International

International revenue for the third quarter of 2022 was $152.7 million, a decrease of $15.1 million or 9.0% and an increase of 3.5% on a constant currency basis compared to the third quarter of 2021. Excluding the negative impact of foreign exchange of $20.9 million and the impact of divestitures, organic revenue on a constant currency basis increased 4.3%.

- Finance and Risk revenue for the third quarter of 2022 was $102.2 million, a decrease of $6.5 million or 6.0% and an increase of 5.6% on a constant currency basis compared to the third quarter of 2021.

- Sales and Marketing revenue for the third quarter of 2022 was $50.5 million, a decrease of $8.6 million or 14.4% and a decrease of 0.5% on a constant currency basis compared to the third quarter of 2021.

International adjusted EBITDA for the third quarter of 2022 was $51.6 million, a decrease of 4.4%, with adjusted EBITDA margin of 33.8%.

International revenue for the nine months ended September 30, 2022 was $477.4 million, a decrease of $24.0 million or 4.8% and an increase of 4.2% on a constant currency basis compared to the nine months ended September 30, 2021. Excluding the negative impact of foreign exchange of $45.1 million and the impact of divestitures, organic revenue on a constant currency basis increased 4.8%.

- Finance and Risk revenue for the nine months ended September 30, 2022 was $313.1 million, a decrease of $7.0 million or 2.2% and an increase of 6.0% on a constant currency basis compared to the nine months ended September 30, 2021.

- Sales and Marketing revenue for the nine months ended September 30, 2022 was $164.3 million, a decrease of $17.0 million or 9.3% and an increase of 1.0% on a constant currency basis compared to the nine months ended September 30, 2021.

![]() International adjusted EBITDA for the nine months ended September 30, 2022 was $153.2 million, an increase of 3.4%, with adjusted EBITDA margin of 32.1%.

International adjusted EBITDA for the nine months ended September 30, 2022 was $153.2 million, an increase of 3.4%, with adjusted EBITDA margin of 32.1%.

Source: D&B Earnings Release