In a letter to its shareholders by its independent Chairman Mark L. Feidler and Chief Executive Officer Mark W. Begor stressed Equifax’s achievements in Diversified Data, Analytics and Technology – Positive Consumer Impact by Helping People Live Their Financial Best.

“2022 was a strong year for the New Equifax. We are truly a diversified data, analytics and technology company that is shifting into our Next Gear and extending well beyond a traditional credit bureau in the markets we serve worldwide. We are driving innovation to meet the evolving needs of global consumers and customers while delivering strong financial results for our shareholders.

“2022 was a strong year for the New Equifax. We are truly a diversified data, analytics and technology company that is shifting into our Next Gear and extending well beyond a traditional credit bureau in the markets we serve worldwide. We are driving innovation to meet the evolving needs of global consumers and customers while delivering strong financial results for our shareholders.

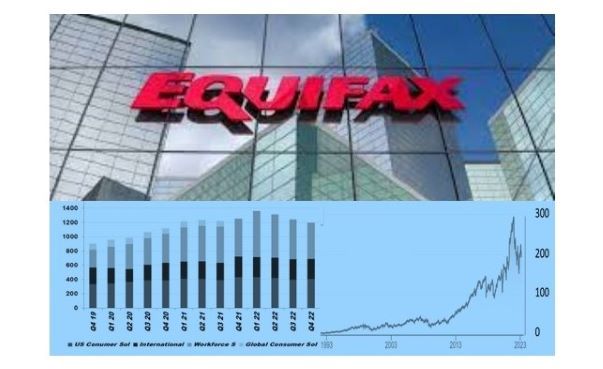

Equifax achieved record 2022 annual revenue of $5.122 billion, up 4% over 2021 despite an unprecedented estimated 56% decline in U.S. mortgage originations and a softening of the global macroeconomic environment. The power of the Equifax business model and our  execution against our EFX2025 strategic priorities is reflected in our eight consecutive quarters of strong, double digit core revenue growth – and strong 17% non-mortgage growth in 2022. Our non-mortgage businesses comprised 77% of Equifax and delivered growth in 2022 well above our 8-12%long-term growth framework.

execution against our EFX2025 strategic priorities is reflected in our eight consecutive quarters of strong, double digit core revenue growth – and strong 17% non-mortgage growth in 2022. Our non-mortgage businesses comprised 77% of Equifax and delivered growth in 2022 well above our 8-12%long-term growth framework.

In 2022, we harnessed the power of our new Equifax Cloud™ capabilities and differentiated data to deliver more than 100 new products for a record setting Vitality Index (defined as revenue from new products introduced in the last three years) of 13%, which is well above our 10% long term vitality target for new products and 400 basis points above 2021. North American revenue from products delivered from an application running in the new Equifax Cloud reached a record of approximately 70%, up from 50% in 2021. We also continued to invest in strategic, bolt-on acquisitions to strengthen our company and drive future growth and have signed or completed 14 transactions for consideration totaling $4.1 billion since the beginning of 2021. We continue to set ourselves apart in the industry with innovative solutions and differentiated data assets that ‘Only Equifax’ can provide.

Equifax Overall Revenue $5.1B: Up 4%, delivering strong 17% non-mortgage growth in an unprecedented mortgage market decline

At the Business Unit Level in 2022

Workforce Solutions $2.3B – Workforce Solutions, our fastest growing, highest margin, and most valuable business, delivered annual revenue of $2.3 billion – growth of 14% over 2021. Importantly, Workforce Solutions non-mortgage revenue, which represents 67% of revenue, was up a very strong 42%. This business unit has more than doubled in size over the past several years and has grown from about 25% of our total revenue four years ago to almost 50% in 2022. It will likely exceed more than half of Equifax revenue in the coming years!

U.S. Information Solutions $1.7B – U.S. Information Solutions (USIS) delivered annual revenue of $1.7 billion, a decline of 7% from 2021 due to the declining 2022 mortgage market, which was partially offset by strong 6% business-to-business(B2B) non-mortgage growth and B2B Online non-mortgage revenue growth of 11.5%. In March 2023, we announced the appointment of Todd Horvath as President of USIS effective March 31, 2023. Horvath will drive our USIS growth strategy – leveraging the company’s differentiated data assets, Equifax Cloud-based technology and deep analytics expertise to create innovative solutions that drive financial opportunity for businesses and consumers. He joins Equifax from Fiserv, where he most recently served as the Co-Head of the Fiserv Banking organization.

International $1.1B – International, for the second year in a row, achieved more than a billion dollars in revenue and double-digit local currency growth, to $1.1 billion, up 12% in local currency. We are seeing broad-based execution from our International businesses, with strong double digit local currency revenue growth in our Latin America (LATAM) and Europe regions.

Strong Financial Performance

Our strong financial performance was supported by the significant strides we have made to complete our Equifax Cloud transformation. This new Cloud infrastructure is delivering always-on capabilities and faster New Product Innovation, with integrated data assets, faster data delivery and industry leading enterprise security. Approximately 70% of our North American revenue is now being delivered from the Equifax Cloud and in 2023 we are focused on completing our North American cloud transformation to become the only cloud native data and analytics company.

The strength of the New Equifax worldwide is supported by our nearly 14,000 Equifax employees in 24 countries who have helped our customers adapt to a challenging post- COVID economic landscape, enabling them to support rapidly evolving consumer needs.

A few of our 2022 highlights include:

We delivered more than 100 new products for the third year in a row with a Vitality Index of 13%, a new record for Equifax. New product revenue in 2022 was $650 million, up over 50% from about $420 million in 2021.

U.S. Information Solutions is leading the industry with a new mortgage credit report that includes 15 telecommunications, pay TV and utilities attributes to help streamline the mortgage underwriting process and support loans within the secondary mortgage market. Equifax is the first and only in the industry to provide these differentiated insights, which were made available to Equifax customers in the first quarter of 2023 and can help create greater home ownership opportunities for more than 191 million U.S. consumers, 80% of whom have traditional credit files, but may benefit from additional insights into their financial profile that can make mortgage underwriting faster and easier.

Workforce Solutions introduced the TotalVerify™ data hub, a single source for obtaining the data insights that social service agencies, lenders, background screeners and employers leverage to build trust, enable safety, verify information and assess risk. TotalVerify is the culmination of years of Equifax development, augmented by the acquisition of Appriss Insights in 2021. This secure, multi-faceteddata and analytics hub is anchored by The Work Number® database and powered by the Equifax Cloud. Workforce Solutions data is driving a Vitality Index approximately two times the company average.

Our International business continues to execute well, with particular strength in our LATAM New Product Innovation. With a regional Vitality Index well above our 10% long term target, the International team is creating solutions that fit each of the 11 countries in the LATAM region to expand and accelerate growth.

The uniqueness and value of The Work Number database was clear again in 2022. New partnerships along with growth in existing partner records and new direct contributors, drove growth – with current records in The Work Number database reaching 152 million active records, an increase of 12%, or 16 million records, from 2021. This includes 114 million unique individuals and represents 70% of U.S. non-farm payroll and approximately 55% of working Americans.

Workforce Solutions continues to accelerate international expansion in the U.K., Canada and Australia with access to over 20 million active and historical payroll records outside of the U.S., as well as over 40 million active and historical alternative income records such as pension data and tax returns.

We have reinvested our strong performance by signing or completing 14 strategic and accretive bolt-onacquisitions totaling more than $4.1 billion since the beginning of 2021. In 2022, we enhanced our robust Workforce Solutions suite of employer services with the acquisition of Efficient Hire and LawLogix. We expanded our international presence with the acquisition of Data-Crédito, the largest consumer credit reporting agency in the Dominican Republic, and have signed a definitive agreement to acquire Boa Vista Serviços (BOAS3: SAO), the second-largest credit bureau in Brazil. We also continued to expand our digital identity network with the combination of the Kount business and our 2022 acquisition of Midigator.

Security has become a point of strength and a competitive advantage for Equifax. In 2022, the maturity level of our cybersecurity program exceeded all major industry benchmarks for the third consecutive year, with a posture that ranks in the top 1% of Technology companies and top 3% of Financial Services companies analyzed.

Consumer Impact: Helping People Live Their Financial Best

Our company purpose is to help people live their financial best and Equifax strives to support economically healthy individuals and financially inclusive communities in each of the 24 countries where we do business. This purpose-driven focus was recognized in 2022 with a Google Customer Award for Diversity, Equity and Inclusion.

Financial inclusion is at our core and Equifax is committed to helping people and small businesses access useful and affordable financial products and services that meet their needs – including payments, savings, credit, insurance and government benefits – delivered in a responsible and sustainable way. Every financial first – whether it’s a first job, a college education, a bank account, credit card, car loan, apartment lease, small business loan, government benefit or mortgage – can spur positive economic change.

Positive economic change starts with a single financial opportunity.”

Source: Equifax