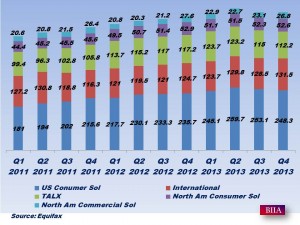

Equifax Inc. (NYSE:EFX) reported revenue from continuing operations of $578.5 million in the fourth quarter of 2013, an 8 percent increase from the fourth quarter of 2012.

Equifax Inc. (NYSE:EFX) reported revenue from continuing operations of $578.5 million in the fourth quarter of 2013, an 8 percent increase from the fourth quarter of 2012.

For the full year 2013, revenue was $2.3 billion, an 11 percent increase from 2012, both on a GAAP and adjusted basis. Diluted EPS from continuing operations attributable to Equifax was $2.69, a 24 percent increase from $2.18 for the full year 2012. On a non-GAAP basis, full year adjusted EPS from continuing operations attributable to Equifax was $3.60, up 24 percent from the prior year period; this financial measure excludes the same items as those in the fourth quarter of both 2013 and 2012.

“Our fourth quarter performance continues to reflect strong execution on our strategic growth initiatives, including new product innovation, deeper penetration of our key end-user markets, and strategic acquisitions,” said Richard F. Smith, Equifax’s Chairman and Chief Executive Officer. “On a number of measures, 2013 was a record year for Equifax. We ended the year with revenue growth of 11% and 24% growth in Adjusted Earnings per Share. We have a number of exciting initiatives underway and I anticipate we will deliver another year of solid performance in 2014.”

“Our fourth quarter performance continues to reflect strong execution on our strategic growth initiatives, including new product innovation, deeper penetration of our key end-user markets, and strategic acquisitions,” said Richard F. Smith, Equifax’s Chairman and Chief Executive Officer. “On a number of measures, 2013 was a record year for Equifax. We ended the year with revenue growth of 11% and 24% growth in Adjusted Earnings per Share. We have a number of exciting initiatives underway and I anticipate we will deliver another year of solid performance in 2014.”

Full Year 2014 and First Quarter 2014 Outlook: Based on the current level of domestic and international business activity, current trends in foreign exchange rates, and an anticipated slowdown in mortgage activity in the first half of 2014, consolidated revenue for the full year of 2014 is expected to be between $2.425 billion and $2.475 billion and full year 2014 Adjusted EPS is expected to be between $3.75 and $3.89.

For the first quarter of 2014, consolidated revenue is expected to be between $575 million and $588 million and first quarter 2014 Adjusted EPS is expected to be between $0.84 and $0.88.

Source: Equifax Earnings Report