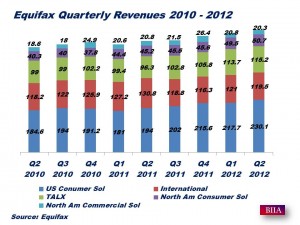

Following an impressive Q1 performance Equifax again pulled ahead with record second quarter results: Revenues were up 15% (Non GAAP and local currency basis), Operating income was up 18%. Highlights:

U.S. Consumer Information Solutions (USCIS): Total revenue was $230.1 million in the second quarter of 2012 compared to $194.0 million in the second quarter of 2011, an increase of 19 percent.

U.S. Consumer Information Solutions (USCIS): Total revenue was $230.1 million in the second quarter of 2012 compared to $194.0 million in the second quarter of 2011, an increase of 19 percent.

- Operating margin for USCIS was 38.3 percent in the second quarter of 2012 compared to 36.5 percent in the second quarter of 2011.

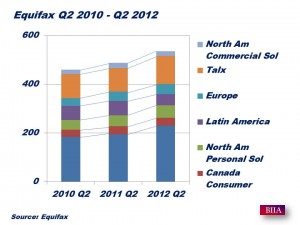

- International: Total revenue was $119.5 million in the second quarter of 2012, a 9 percent decrease from the second quarter of 2011. On a non-GAAP basis, excluding Brazil, revenue grew 4 percent on a reported basis and 9 percent on a local currency basis.

- Canada Consumer revenue was $31.9 million, up 2 percent in local currency and down 2 percent in U.S. dollars from a year ago.

- Operating margin for International was 29.2 percent in the second quarter of 2012 compared to 26.1 percent in the second quarter of 2011.

- Workforce Solutions: Total revenue was $115.2 million in the second quarter of 2012, a 20 percent increase over the second quarter of 2011.

- Operating margin for Workforce Solutions was 23.4 percent in the second quarter of 2012 compared to 21.6 percent in the second quarter of 2011.

- North America Personal Solutions: Revenue was $50.7 million, a 12 percent increase from the second quarter of 2011.

- Operating margin was 29.8 percent compared to 27.7 percent in the second quarter of 2011.

- North America Commercial Solutions: Revenue was $20.3 million, down 2 percent in U.S. dollars and 1 percent in local currency compared to the second quarter of 2011.

- Operating margin was 14.0 percent, compared to 20.9 percent in the second quarter of 2011

Third Quarter 2012 Outlook: Based on the current level of domestic and international business activity and current foreign exchange rates as well as continued strength in mortgage activity, consolidated revenue for the third quarter of 2012 is expected to be up 9 to 11 percent from the year-ago quarter. Third quarter 2012 adjusted EPS attributable to Equifax, which excludes the impact of acquisition-related amortization expense, is expected to be between $0.71 and $0.74.

Source: Equifax Press Release