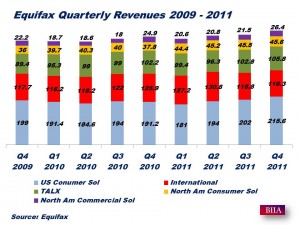

Equifax Inc. (NYSE: EFX) announced financial results for the quarter ended December 31, 2011. The company reported revenue from continuing operations of $509.7 million in the fourth quarter of 2011, a 6 percent increase from the fourth quarter of 2010. On a non-GAAP basis, fourth quarter revenue was up 10 percent, excluding Brazilian operating results due to the deconsolidation of Brazil in the second quarter of 2011.

Equifax Inc. (NYSE: EFX) announced financial results for the quarter ended December 31, 2011. The company reported revenue from continuing operations of $509.7 million in the fourth quarter of 2011, a 6 percent increase from the fourth quarter of 2010. On a non-GAAP basis, fourth quarter revenue was up 10 percent, excluding Brazilian operating results due to the deconsolidation of Brazil in the second quarter of 2011.

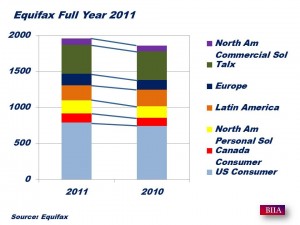

For the full year 2011, revenue from continuing operations was $2.0 billion, a 5 percent increase from 2010. Excluding Brazilian operating results, a non-GAAP measure, full year revenue was up 8 percent. Diluted EPS from continuing operations was $1.87 compared to $1.86 for the full year 2010. On a non-GAAP basis, full year adjusted EPS from continuing operations, which excludes the impact of acquisition-related amortization expense, the loss on the deconsolidation of our Brazilian business and an income tax benefit, was $2.52, up 9 percent from the prior year period. For the full year 2011, we returned $220.4 million of cash to shareholders through dividends and stock repurchases during the year.

Equifax US consumer information solutions grew by 13% in the fourth quarter lifting its full year results by 7% to US$792.6 million. The deconsolidation of its Brazilian operations impacted Latin American results by revenues declining 10% to US$208.8 million. European revenues grew by 15% to US$158.7 million. Canada consumer segment grew by 10% to US$125.4 million. TALX workforce solutions had an unusually anemic growth of 2% with revenues of US$404.3 million. North American consumer solutions grew by an impressive 15% to US$180.7 million. North American commercial solutions grew by 11% to US$89.3 million. What has Equifax up its sleeves to result in a double digit growth rate with a 34.4% margin in its domestic commercial credit solutions business? Equifax’s CEO Rick Smith stated in his opening remarks during today’s earnings call that growth in North American commercial solutions was driven largely by improved analytics.

First Quarter 2012 Outlook: Based on the current level of domestic and international business activity that Equifax have experienced through the current date and current foreign exchange rates, consolidated revenue from continuing operations for the first quarter of 2012 is expected to be up 9 to 12 percent from the year-ago quarter, excluding Brazil.

Source: Equifax Press Release