The latest European Credit Risk Outlook, based on a survey of risk managers by FICO and Efma, gives a different picture than the one we released in June. The optimism in that report has largely slipped away.

The latest European Credit Risk Outlook, based on a survey of risk managers by FICO and Efma, gives a different picture than the one we released in June. The optimism in that report has largely slipped away.

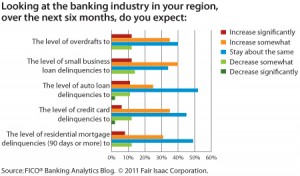

Credit risk managers across Europe now expect that more consumers will have trouble making payments on a variety of loan types. In fact, the ratio of respondents who predict delinquencies will get worse to those who predict delinquencies will get better is about 4:1 for overdrafts, small business loans and credit cards, and 3:1 for auto loans and mortgages.

A darker picture also emerged in FICO’s most recent survey of U.S. risk managers. It remains to be seen whether the forthcoming solutions to the Eurozone crisis will affect what risk managers worldwide see as darker times ahead for credit users.

Source: FICO Bankinganalyticsblog

Risk Management Gains Strength in Europe

In FICO’s recent survey, credit risk managers across Europe clearly indicate that they are better prepared now to deal with a rise in risk. 77 percent of respondents say that they have made changes to their risk management processes to deal with the economic downturn since 2008. They also say that their approach to risk management is more disciplined than three years ago (83 percent) and that they can adapt policies rapidly (79 percent). A full 97 percent say that their credit decisions are made with a strong understanding of borrower debt capacity.

Credit risk remains a challenge in most markets today, due to unemployment, sovereign debt concerns and weak economic results. The good news is that lenders are better prepared now than they were three years ago.

Source: FICO Bankinganalyticsblog