Total revenue from continuing activities was US$4,477m, with both total and organic revenue at constant exchange rates up 5%. At actual exchange rates, total revenue from continuing activities fell by 4% reflecting foreign exchange headwinds during the period. Total revenue was US$4,550m as the Group exited a number of non-core businesses in the year.

Total revenue from continuing activities was US$4,477m, with both total and organic revenue at constant exchange rates up 5%. At actual exchange rates, total revenue from continuing activities fell by 4% reflecting foreign exchange headwinds during the period. Total revenue was US$4,550m as the Group exited a number of non-core businesses in the year.

- EBIT from continuing activities was US$1,195m, up 5% at constant exchange rates. At actual exchange rates, EBIT from continuing activities was down 6%. Total EBIT was US$1,210m.

- EBIT margin from continuing activities was stable at constant exchange rates. The impact of foreign exchange movements reduced EBIT margin at actual exchange rates by 60 basis points to 26.7%.

- Benchmark profit before tax was US$1,136m, up 3% at constant exchange rates. Profit before tax was US$1,027m at actual exchange rates (2015: US$1,006m).

- Cash flow conversion of 105%. Net debt decreased by US$194m, with net debt to EBITDA ratio remaining at 1.9 times.

- Definitive agreement post year-end to acquire CSIdentity Corporation.

Brian Cassin, Chief Executive Officer, commented: “We have made significant progress against our strategic objectives over the past year. We have returned Experian to organic revenue growth within our target range and driven greater efficiencies in our business, whilst rigorously applying our robust capital framework. As we look forward, we’re investing in a range of initiatives which will help us deliver another year of good growth, within our target range of mid-single-digit organic revenue growth, with stable margins and further progress in Benchmark earnings per share.”

Brian Cassin, Chief Executive Officer, commented: “We have made significant progress against our strategic objectives over the past year. We have returned Experian to organic revenue growth within our target range and driven greater efficiencies in our business, whilst rigorously applying our robust capital framework. As we look forward, we’re investing in a range of initiatives which will help us deliver another year of good growth, within our target range of mid-single-digit organic revenue growth, with stable margins and further progress in Benchmark earnings per share.”

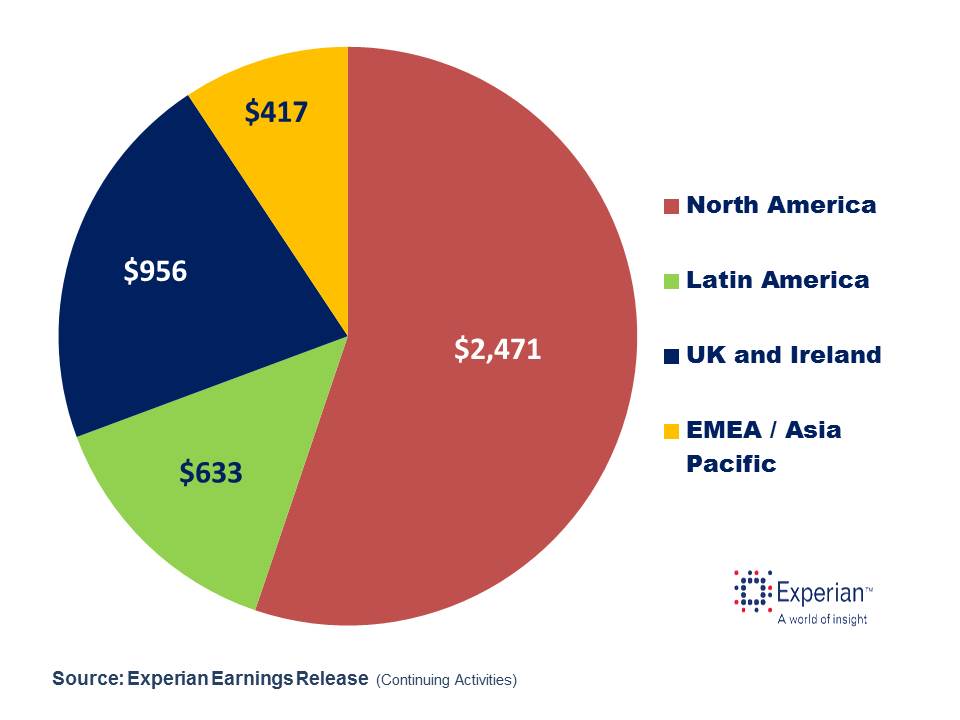

North America: We returned to growth in North America during the year, with organic revenue up 3%.

North America: We returned to growth in North America during the year, with organic revenue up 3%.- Latin America: Helped by counter-cyclical revenues and our new growth initiatives, our business in Latin America has held up well in a worsening economic environment, with organic revenue growth of 7%.

- UK and Ireland We delivered a good performance in the UK and Ireland, with organic revenue growth of 5%

- EMEA/Asia Pacific: We have delivered good revenue growth in EMEA/Asia Pacific, with organic revenue growth of 7%.

Summary: The Group made significant progress during the year, with organic revenue growth improving to an average of 5% for the year as a whole. At constant currency, EBIT margin was stable, reflecting continued focus on efficiency and investment in our strategic growth initiatives.

The Group reports its financial results in US dollars and therefore the weakness of the Group’s other trading currencies (primarily the Brazilian real) against the US dollar during the year decreased our total revenue by US$412m and Total EBIT by US$137m, with an adverse impact on EBIT margin of 60 basis points.

Source: Experian Earnings Release