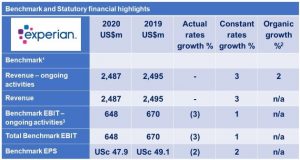

Experian plc, the global information services company, has issued its half-yearly financial report for the six months ended 30 September 2020 reporting revenue growth for H1 at constant currency was +3%.

Brian Cassin, Chief Executive Officer, commented:

“Against the backdrop of the global pandemic we delivered a resilient performance in H1, with organic revenue growth of 2% and modest progress in constant currency EBIT. Q2 organic revenue growth was 5%, at the top end of our guidance range. The drivers of growth stemmed largely from North America and Brazil which offset COVID-19 related declines in other territories. The stand out performance across the Group was Consumer Services, where we now have nearly 100m free consumer memberships. For Q3 we expect organic revenue growth in the range of 3% to 5%.

“Against the backdrop of the global pandemic we delivered a resilient performance in H1, with organic revenue growth of 2% and modest progress in constant currency EBIT. Q2 organic revenue growth was 5%, at the top end of our guidance range. The drivers of growth stemmed largely from North America and Brazil which offset COVID-19 related declines in other territories. The stand out performance across the Group was Consumer Services, where we now have nearly 100m free consumer memberships. For Q3 we expect organic revenue growth in the range of 3% to 5%.

“While COVID-19 has significantly impacted the macroeconomic environment, it has also catalysed trends which play to Experian’s strengths. Innovation is our bedrock and has driven success for us in the marketplace. Once the crisis abates, we believe we will be strongly positioned to take advantage of the secular growth trends and we are excited by the opportunities we see ahead.”

1 See Appendix 3 (page 14) and note 5 to the interim financial statements (pages 23-25) for definitions of non-GAAP measures. 2 Organic revenue growth at constant currency. 3 See page 14 for reconciliation of Benchmark EBIT to Profit before tax.

Resilient first-half financial performance

- Revenue growth for H1 at constant currency was +3%.

- H1 organic revenue +2%, with Q1 (2)%, Q2 +5%.

- H1 organic revenue in North America and Latin America +7% and +5% respectively. Organic revenue in UK and Ireland and EMEA/Asia Pacific of (12)% and (18)% respectively.

- H1 organic Business-to-Business (B2B) revenue (2)%, organic Consumer Services revenue +13%.

- Q2 organic revenue in North America and Latin America +9% and +10% respectively. Q2 UK and Ireland and EMEA/Asia Pacific (8)% and (17)% respectively.

- Q2 organic revenue growth in B2B and Consumer Services +1% and +17% respectively.

- US mortgage growth added 3% to Q2 growth for the Group.

- H1 Benchmark EBIT growth at constant exchange rates of 1%.

- H1 Benchmark EBIT margin of 26.1% at actual exchange rates (2019: 26.9%).

- H1 Benchmark EPS growth of 2% at constant rates and (2)% at actual exchange rates.

- First interim dividend of 14.5 US cents per ordinary share, unchanged year-on-year.

View the full press release in PDF format.

Source: Experian Earnings Release