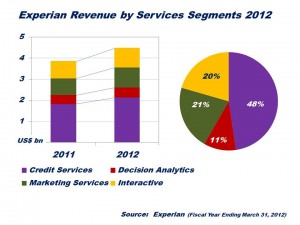

Experian reports record results for the financial year ending March 31st 2012. Total revenue from continuing activities is up 16%. At constant exchange rates, revenue from continuing activities up 15%. Organic revenue growth was 10% (excluding discontinued operations). Total Group revenue of US$4.5bn (2011: US$3.9bn). Good margin progression. EBIT margin from continuing activities up 50 basis points to 26.2%.

Experian reports record results for the financial year ending March 31st 2012. Total revenue from continuing activities is up 16%. At constant exchange rates, revenue from continuing activities up 15%. Organic revenue growth was 10% (excluding discontinued operations). Total Group revenue of US$4.5bn (2011: US$3.9bn). Good margin progression. EBIT margin from continuing activities up 50 basis points to 26.2%.

North America: Total revenue from continuing activities was US$2,092m, up 10%, with organic revenue growth of 6%. The difference relates primarily to the acquisitions of Mighty Net (acquired September 2010) and Medical Present Value (acquired June 2011).

Latin America: Performance goes from strength to strength. Total revenue from continuing activities was US$961m, up 31% at constant exchange rates, with organic revenue growth of 23%. The difference relates to the acquisitions of Virid Interatividade Digital (Virid) (acquired July 2011) and Computec (completed November 2011).

UK and Ireland: In the UK and Ireland, revenue from continuing activities was US$824m, up 10% at constant exchange rates. Organic revenue growth was 8%. The acquisition contribution relates to LM Group (acquired July 2011), 192business (completed February 2012), and Garlik (acquired December 2011).

EMEA/Asia Pacific: Total revenue from continuing activities in EMEA/Asia Pacific was US$608m, up 17% at constant exchange rates, with organic revenue growth of 7%. The difference in part relates to the move to a majority holding in DP Information in Singapore (April 2011).

Source: Experian Press Release