Are you a “Mobile Native”? You are if you interact with businesses every day on your mobile phone or tablet. And if you are, you’re more likely to be living in China than in the U.S. or Europe, according to FICO’s latest research.

In an international survey of businesses and consumers, China (51 percent) and Korea (50 percent) were joined by India (49 percent) as the countries with the highest percentage of Mobile Native consumers. The countries with the lowest percentage of mobile natives were France (12 percent), Japan (15 percent) and — surprisingly — the United States (16 percent).

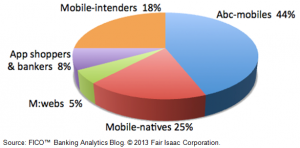

The 2,200+ adult smartphone users surveyed fell into five categories:

- Mobile Natives tend to be technologically savvy. They are typically young (under 34 years of age), affluent males who consider themselves early adopters of technology.

- App Shoppers and Bankers are frequent app users, but they typically use their devices for the limited purposes of banking or retail shopping.

- M:webs have adopted mobile technology but are not accustomed to using mobile apps.Mobile Intenders plan to do more mobile interactions in the future

- Abc-Mobiles use a mobile phone but don’t typically interact with organizations via mobile devices. This is often due to an unwillingness to share personal data and a low level of trust with online businesses.

Mobile User Categories:

Respondents said they are most likely to use their mobile devices to interact with retailers, followed by banks, then insurers, Among the applications offered by retailers and financial institutions, the most popular type in every one of the 14 countries surveyed is alerts, such as apps that notify consumers of suspicious transactions. More than 72 percent of respondents described such apps as attractive.

What does this mean for banks? There is a huge opportunity to engage more customers, around the world. This validates FICO’s own observations, as we have noted here before: customers are leading the mobile revolution.

Source: FICO Banking Analytics Blog