Highlights:

- Only 18 percent of Asia Pacific banks have a strategic plan to fully integrate their fraud and anti-money laundering compliance functions, while 38 percent prefer a more tactical approach, to actively share resources where synergies exist.

- Most Asia Pacific banks currently run fraud and financial crime compliance functions that are fully separate or only have a low level of collaboration.

- 61 percent of Asia Pacific banks are keen to achieve their convergence ambitions in three years or less.

More information: https://www.fico.com/en/products/falcon-x

More information: https://www.fico.com/en/products/falcon-x

A recent survey by global analytics software firm FICO has revealed that only 18 percent of Asia Pacific (APAC) banks have a strategic plan to fully integrate their fraud and anti-money laundering (AML) compliance functions, even though 71 percent say that convergence will improve the ability to stop fraud and financial crimes.

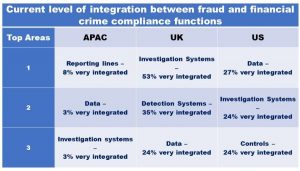

This puts their planning efforts significantly behind that of their Western peers. In an earlier survey commissioned by FICO in 2019, 24 percent of US banks and 47 percent of UK banks had strategic plans to fully integrate functions. FICO estimates that 80 percent of the functionality to do fraud checks and AML checks on a new account opening is the same.

Most Asia Pacific banks (38 percent) are instead actively looking at a more tactical approach, actively sharing resources where synergies exist. Examples of this being the sharing of data, controls or staff. Just 12 percent of banks in both the US and UK said they were pursuing this approach.

To read the full story, click on this link: FICO Press Release