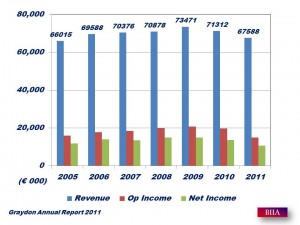

The Supervisory Board noted that Graydon has experienced a difficult year in 2011 as a consequence of tough market conditions. This is still the result from the financial crisis and intensified competitive and changing market dynamics. Under these conditions the operating profit decreased to € 14,913,000 (2010: € 19,749,000).

The Supervisory Board noted that Graydon has experienced a difficult year in 2011 as a consequence of tough market conditions. This is still the result from the financial crisis and intensified competitive and changing market dynamics. Under these conditions the operating profit decreased to € 14,913,000 (2010: € 19,749,000).

Strong pressure on credit management activities in the Netherlands and Belgium: The delayed impact of the 2008/2009 economic recession was not felt in our operations until the fourth quarter of 2010, with particularly sharp falls in revenue and results in the credit management activities. The impact was aggravated in 2011 by the debt crisis in the second half of the year. The business climate weakened further and demand for credit management information declined as corporate clients sought cost savings.

The Dutch market was hit hardest, on account of the downsizing of contracts in combination with steep price erosion. In the Netherlands, moreover, a commodity player has strengthened its market position and other parties started selling some of the information offered by Graydon. Prices in the market accordingly came under extreme pressure as well as committed value contracts. Belgium, too, faced similar circumstances in the traditional credit management information activities.

Debtor management and debt collection services had a mixed year. In the Netherlands, the market and fees came under pressure. The volume of debts in the market was undermined by the drop in economic activity and businesses gave higher priority to their own cost saving programs than to engaging debt collection services. In

Belgium, however, where debt collection is a relatively small activity, there was a slight increase in the activities.

The marketing support service in the Netherlands also suffered a drop in revenue as established clients committed to fewer data purchases. The same problems were seen in the call centre activities. Competition was aggravated by overcapacity in the market. In Belgium, by contrast, Graydon again achieved substantial growth.

Growth in Secondment and Training: In the Netherlands the measures taken to position secondment more prominently as a separate dedicated service met with success. Despite the strong competition in a market squeezed by the recession, Graydon successfully achieved a pronounced increase in revenue in this market. In Belgium, Graydon can look back on a good year for training services. Income rose sharply. In the Netherlands, the training concept was refined and is now being applied successfully as a support service tool for the credit management activities. As a result, revenue from this activity was lower.

PROSPECTS FOR 2012

Further economic growth contraction in the eurozone is expected in 2012. This is expected to have an adverse impact on the traditional credit information market. Provided there is no further deterioration in market conditions, Graydon expects to reverse the downward trend seen in the past two years by bringing forward the introduction of new concepts developed in 2011 in order to lift sales volumes and provide access to new user target groups.

Graydon will also continue to exercise strict cost control. No additional investments or changes in personnel are planned, other than to support the business as usual.

On 1st of March 2012, the President of the Company retired after 25 years of service. His contribution to Graydon over the past 25 years has been valued and appreciated. The selection of a successor for this position of CEO is now in progress. Gertjan Kaart has been appointed as CEO ad interim, next to his responsibilities as Managing Director of Graydon Nederland B.V.

Source: Graydon Annual Report 2011