New offerings and streamlined operations mark transition to becoming a new model customer experience company

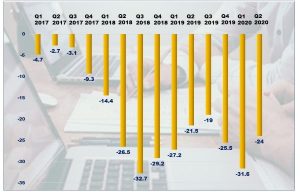

Harte Hanks, Inc. (OTCQX: HRTH), a leading, data-driven customer experience company, has reported second quarter revenues were $41.6 million, compared to $54.7 million during the same quarter last year, a $13.1 million, or a 24% decline. Second quarter revenues were up $1.1 million compared to $40.5 million last quarter, led by growth in B2B and Consumer Brands. The year over year decline was due to lower revenue in verticals mainly led by Retail and Transportation.

Second quarter operating loss was $5.9 million, compared to an operating loss of $6.6 million in the same quarter last year. The improvement was a result of the Company’s cost reduction efforts, which lowered operating expenses by $13.8 million. Second quarter Adjusted Operating Loss was $563,000, compared to a loss of $3.1 million in the prior year quarter. The improvement in Adjusted Operating Loss reflects substantial cost-cutting actions taken by management.

Loss attributable to common stockholders for the second quarter was $6.4 million, or $0.99 per basic and diluted share, including a tax benefit of $1.5 million due to changes from the CARES Act allowing NOLs generated in 2018 through 2020 to be carried back for 5 years. In the prior year period, loss attributable to common stockholders was $3.9 million, or a loss of $0.63 per basic and diluted share.

“We have made significant progress in our goal to position Harte Hanks for sustainable profitability, despite the difficult headwinds that our industry faces due to COVID-19. We continue to carefully evaluate expenses and business functions to ensure we add value to our customers,” commented Andrew Benett, Executive Chairman and Chief Executive Officer. “We stabilized our quarterly revenue run rate and implemented cost reductions across every aspect of the company, leading to over $20 million in savings annually. We also further strengthened our management team with the additions of Drew Rayman and Craig Wishner, to lead our DTC/e-Commerce practice, and John Cook, who will lead our automotive practice for our Business Development team.”

“We have made significant progress in our goal to position Harte Hanks for sustainable profitability, despite the difficult headwinds that our industry faces due to COVID-19. We continue to carefully evaluate expenses and business functions to ensure we add value to our customers,” commented Andrew Benett, Executive Chairman and Chief Executive Officer. “We stabilized our quarterly revenue run rate and implemented cost reductions across every aspect of the company, leading to over $20 million in savings annually. We also further strengthened our management team with the additions of Drew Rayman and Craig Wishner, to lead our DTC/e-Commerce practice, and John Cook, who will lead our automotive practice for our Business Development team.”

“We further streamlined and positioned the business for success in a changing world by consolidating the data center operations in Austin with our data center in Pennsylvania, and with a planned move of most of our applications and data to the cloud,” Mr. Benett added. “We anticipate finalizing our IT transformation by the second quarter of 2021, resulting in over $2 million in annual savings. We took action on our ‘asset light’ strategy by exiting direct mail production facilities, leading to the asset sale of our Jacksonville direct mail facility at the end of June to Summit Direct Mail. We entered into a strategic partnership with Summit in which Harte Hanks continues to manage and service our customers while reducing the high fixed costs required to support in-house printing operations.”

Mr. Benett concluded, “We are building the model for a new type of customer experience company. We are driven by data, and applying that data to everything we do. What makes us further differentiated is our ability to work deeply with data and drive all the way through to engaging the customer – digitally and physically. As part of this effort, we launched our Sampling offering, utilizing our data and analytics expertise and proficient fulfilment execution.

Our Sampling offering provides a unique and fresh approach to the industry and will be key to building on our momentum. From Sampling to the growth of our DTC business, we are making significant progress to becoming a differentiated end-to-end solution for our clients. We remain confident that we will be adjusted EBITDA positive for the year and believe we are on track to be FCF positive in the second half of 2021. Our goal is to emerge from 2020 a stronger, better company by helping our customers embrace new marketing imperatives more effectively and efficiently.”

Source: Harte-Hanks Earnings Release

![Salesforce Q4 2024 Revenue Up 11%, FY Up 11% [Fiscal Year Ended January 31, 2024]](https://www.biia.com/wp-content/uploads/2024/03/Salesforce-Fiscal-2024-Fin-Results-ended-Jan31-2024-440x264.jpg)