Service Puts L ifeLock on Standby to Protect an Organization’s Customers or Employees Following a Breach

ifeLock on Standby to Protect an Organization’s Customers or Employees Following a Breach

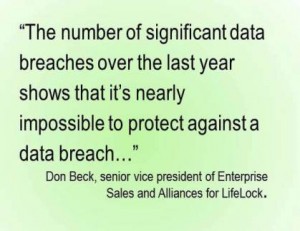

LifeLock, Inc. introduced a new service for organizations to integrate identity theft protection into their data breach response plans. LifeLock Data Breach Service enables organizations to rapidly activate LifeLock if they are exposed by a data breach and help protect their customers or employees from identity fraud.

LifeLock has provided breach response services for enterprises for several years, and this new service is designed to help organizations plan their response to data breaches. LifeLock Data Breach Service establishes a pre-negotiated plan to mobilize LifeLock identity theft protection for any customers or employees exposed by a future breach at a discounted rate. Companies do not pay for the service unless a breach occurs and the service is activated. Additionally, LifeLock does not sell members’ data to outside parties.

Identity theft protection for customers is an important part of a checklist for companies developing data-breach crisis plans. A recent study by Forrester Consulting showed that one in three individuals who were notified that their personal information was part of a data breach reported that they experienced identity theft. [1]

Identity theft protection for customers is an important part of a checklist for companies developing data-breach crisis plans. A recent study by Forrester Consulting showed that one in three individuals who were notified that their personal information was part of a data breach reported that they experienced identity theft. [1]

LifeLock Data Breach Service includes:

- Primary LifeLock Alert System: Actionable alerts are sent in near real time when LifeLock detects a Social Security number, name, address or date of birth in applications for credit and services within its network[2]. LifeLock monitors over a trillion data points, including those used for new credit cards, wireless services, retail credit, mortgages, auto and payday loans. Members can choose alerts by text message, phone, or email and respond immediately to confirm if the activity is fraudulent with the company’s proprietary Not Me® verification technology[3].

- Continuous Live Member Support: U.S.-based Member Services Agents are available to help 24 hours a day, 7 days a week, and 365 days a year.

- Certified Resolution Support: A Certified Resolution Specialist will personally handle a case and help restore a member’s good name in case of a fraudulent event. These specialists are Fair Credit Report Act (FCRA) certified and trained on federal legislation, national credit repository guidelines and consumer rights.

- $1 Million Total Service Guarantee: If a LifeLock member becomes a victim of identity theft, LifeLock will spend up to $1 million to hire experts, lawyers, investigators, consultants and necessary professionals to help their recovery [4].

Identity fraud comprises much more than a fraudulent charge on a credit card; it includes new accounts, loans, or services being opened up in a victim’s name without their knowledge. An estimated 16.6 million U.S. citizens have experienced at least one incident of identity theft in 2012[5].

[1] Identity Theft Study, a commissioned survey conducted by Forrester Consulting on behalf of LifeLock, April/May 2014. Results are based on survey participant identity theft and life events of past 12 months.

[2] Network does not cover all transactions.

[3] Fastest alerts require member’s current email address. Phone call alerts made during normal business hours.

[4]The benefits under the Service Guarantee are provided under a Master Insurance Policy underwritten by State National Insurance Company. As this is only a summary please see the actual policy for applicable terms and restrictions at LifeLock.com/legal.

[5] “Victims of Identity Theft, 2012,” Department of Justice, 2013.

Source: Lifelock