Moody’s reported revenue of $756.0 million for the three months ended June 30, 2013, up 18% from $640.8 million for the second quarter of 2012. Operating expenses for the second quarter of 2013 totaled $405.2 million, a 12% increase from the prior-year period. Operating income for the quarter was $350.8 million, a 2 6% increase from $278.5 million for the same period last year. Adjusted operating income, defined as operating income before depreciation and amortization, was $373.9 million, a 24% increase from $300.6 million last year. Diluted earnings per share of $1.00 increased 32% from $0.76 in the second quarter of 2012.

6% increase from $278.5 million for the same period last year. Adjusted operating income, defined as operating income before depreciation and amortization, was $373.9 million, a 24% increase from $300.6 million last year. Diluted earnings per share of $1.00 increased 32% from $0.76 in the second quarter of 2012.

“Moody’s results for the second quarter reflected continued strong operating performance across the Company,” said Raymond McDaniel, President and Chief Executive Officer of Moody’s. “We are pleased to announce we have increased our annualized dividend to $1.00 per share. We also now anticipate total 2013 share repurchases of approximately $1 billion. Our EPS guidance range for 2013 remains $3.49 to $3.59.”

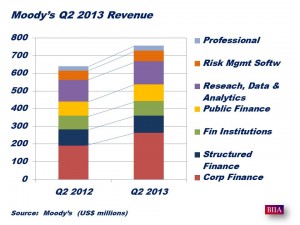

Global revenue for Moody’s Investors Service (“MIS”) for the second quarter of 2013 was $537.3 million, up 22% from the prior-year period. U.S. revenue of $313.2 million for the second quarter of 2013 increased 21% from the second quarter of 2012. Revenue generated outside the U.S. of $224.1 million increased 22% from the year-ago period. The impact of foreign currency translation on MIS revenue was negligible.

Within MIS, global corporate finance revenue of $262.9 million in the second quarter of 2013 increased 37% from the prior-year period, reflecting strong global issuance in investment grade and high yield bonds, as well as in bank loans. Corporate finance revenue increased 28% in the U.S. and 52% outside the U.S.

Global structured finance revenue totaled $97.2 million for the second quarter of 2013, reflecting a 7% increase from a year earlier. U.S. structured finance revenue grew 29% from the year-ago period, primarily due to strength in issuance of commercial mortgage-backed securities. Non-U.S. structured finance revenue declined 17%, mostly reflecting weaker issuance volumes in European residential mortgage-backed and asset-backed securities.

Global financial institutions revenue of $84.5 million in the second quarter of 2013 increased 9% compared to the prior-year period. U.S. financial institutions revenue was up 9%, primarily reflecting stronger banking activity, while non-U.S. revenue grew 8%, driven by increased bond issuance by insurance companies.

Global public, project and infrastructure finance revenue was $92.7 million for the second quarter of 2013, an increase of 14% from the second quarter of 2012. U.S. and non-U.S. revenues were up 8% and 31%, respectively, from the prior-year period, primarily due to gains in project and infrastructure finance globally.

Global revenue for Moody’s Analytics (“MA”) for the second quarter of 2013 was $218.7 million, up 10% from the second quarter of 2012. In the U.S., MA revenue of $95.2 million for the second quarter of 2013 increased 8% from the prior-year period. Outside the U.S., revenue of $123.5 million grew 11% as compared with the same quarter of 2012. The impact of foreign currency translation on MA revenue was negligible.

Revenue from research, data and analytics of $130.3 million increased 7% from the prior-year period, reflecting strong customer retention and solid growth from MA’s research offerings. Enterprise risk solutions revenue of$60.2 million was up 17% over the prior-year period driven by strong growth in products and services that support regulatory and compliance activities at banks and insurance companies. Revenue from professional services of $28.2 million was up 7% from the prior-year period, reflecting solid growth in revenue from Copal Partners, partially offset by softness in the training and certification business.

Outlook: Moody’s full-year 2013 non-GAAP EPS guidance range, which excludes the impact of the litigation settlement charge, remains $3.49 to $3.59. For Moody’s overall, the Company still expects full-year 2013 revenue to grow in the high-single-digit percent range.

Source: Moody’s Press Release