Nicholas Stern, editorial associate of the National Association of Credit Management (NACM) wrote recently: Defaults by Chinese state-owned enterprises (SOEs) are on the rise as Chinese authorities exert less control than a decade ago over the nation’s financial system. This could bring default rates in line with those reported in developed economies, increasing credit risks of China-based companies.

Nicholas Stern, editorial associate of the National Association of Credit Management (NACM) wrote recently: Defaults by Chinese state-owned enterprises (SOEs) are on the rise as Chinese authorities exert less control than a decade ago over the nation’s financial system. This could bring default rates in line with those reported in developed economies, increasing credit risks of China-based companies.

China’s financial system is stressed from slowing growth rates, weakening bank asset quality and significant leverage growth over the past decade, explains Andrew Colquhoun, senior director of sovereigns at FitchRatings, in an April 21 report. Things may be worse for corporate sectors that have experienced “severe over-capacity and weakened credit profiles, but have also benefited from implicit government support in the past,” Colquhoun said. “If investors rapidly change their perceptions of government support in these sectors, it could lead to a disorderly deleveraging.”

In February, electrical transformer manufacturer Baoding Tianwei became the first onshore SOE to default on a corporate bond on principal, while in April, two more SOEs missed bond payments and another SOE had trading of its notes suspended. Several private-sector firms have also defaulted on their corporate bonds. These defaults in turn likely contributed to a rash of bond issue cancellations in March and April.

While the overall default rate is small compared with that in developed markets, a rise in default rates or an unanticipated credit crunch managed without a transparent and consistent process could leave lenders “uncertain as to which SOEs will be allowed to default and over the process for resolving creditors’ claims,” Fitch analysts noted. “In this scenario, even government-controlled banks could become risk averse and be unwilling or unable to lend—a feature evident in other government-controlled banking systems in emerging markets.”

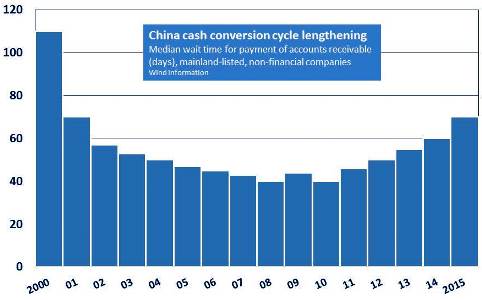

The Financial Times in its Thursday April 28th, 2016 edition raises similar concerns with the headline: “Sluggish Supply Chain Payments Compound China’s Debt Woes”. Trade receivables are now an accepted practice, but payment delays are now on the increase creating a financial bottleneck for companies. Rising payment delays force companies simply to delay payments to suppliers. According to Wind Information, a local publisher of financial data, listed companies have to wait a median 70 days to receceive payments (2015). The longest delay recorded in 14 years. This compares with a median 60 days in 2014 and 46 days in 2011.

The Financial Times in its Thursday April 28th, 2016 edition raises similar concerns with the headline: “Sluggish Supply Chain Payments Compound China’s Debt Woes”. Trade receivables are now an accepted practice, but payment delays are now on the increase creating a financial bottleneck for companies. Rising payment delays force companies simply to delay payments to suppliers. According to Wind Information, a local publisher of financial data, listed companies have to wait a median 70 days to receceive payments (2015). The longest delay recorded in 14 years. This compares with a median 60 days in 2014 and 46 days in 2011.

This raises the spector of ‘Triangular Debt”, a situation which arose in the early 1990’s when company A could not pay company B unless it was paid by company C. The latter having to wait until being paid by B. China’s supply chain is more dense then in Europe or the USA, beause they are concentrated in localities , meaning that bills which remain unpaid for months have a knock-on effect on the local economy.

This raises the spector of ‘Triangular Debt”, a situation which arose in the early 1990’s when company A could not pay company B unless it was paid by company C. The latter having to wait until being paid by B. China’s supply chain is more dense then in Europe or the USA, beause they are concentrated in localities , meaning that bills which remain unpaid for months have a knock-on effect on the local economy.