Santander became the first U.K. bank to use Ripple for cross-border payments, offering a simple payments app running on Ripple’s underlying technology. Recently Ripple announced the addition of seven financial institutions to our ever-growing network.

Santander became the first U.K. bank to use Ripple for cross-border payments, offering a simple payments app running on Ripple’s underlying technology. Recently Ripple announced the addition of seven financial institutions to our ever-growing network.

Santander, UniCredit, UBS, ReiseBank, CIBC, National Bank of Abu Dhabi (NBAD), and ATB Financial are among the latest banks to adopt Ripple to improve their cross-border payments.

Ripple CEO Chris Larsen sees this as a major milestone on our long-term path to realizing the Internet of Value: “We’ve reached a tipping point where financial institutions are moving beyond blockchain experimentation and projects to real world applications that are driving significant bank-to-bank volume. This is a major step forward for the global financial system, and as the Ripple network grows, together we are paving the way for new connected commerce opportunities and growing demands for real-time, high volume, low value global payments.”

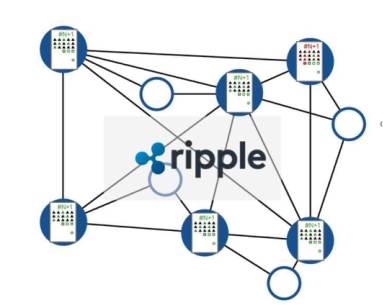

These leading banks are taking advantage of Ripple’s distributed financial technology to drastically reduce the time and cost of settlement and optimize high volume, low value global transactions. Many of these financial institutions are already using Ripple to transfer actual money, and all are aiming to implement the technology in widespread commercial production.

As the only provider of enterprise blockchain solutions, Ripple’s growing, global network includes 12 of the top 50 global banks, ten banks in commercial deal phases, and over 30 bank pilots completed, among many others also using Ripple’s solutions.

At Payments Panorama in Calgary last week, Ripple demonstrated a live transfer of real funds between two of these banks: ATB Financial and ReiseBank. The audience there witnessed a transaction settling in seconds between banks on two continents, with clear fees and complete certainty. They saw the future of cross-border payments.

Source: Ripple Press Release