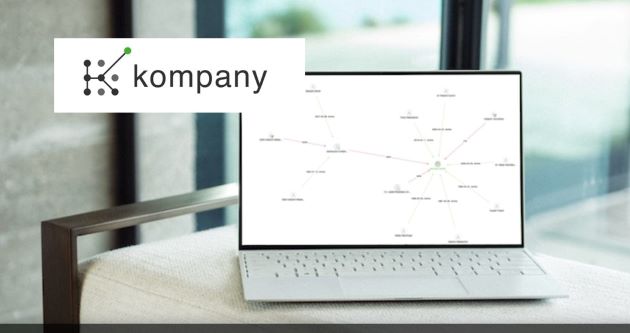

RegTech platform kompany launches pioneering global shareholder discovery technology

UBO discovery® applies artificial intelligence to analyse unstructured shareholder data with a confidence level exceeding human comprehension

Vienna, Austria – Austrian RegTech kompany announced today the launch of its newest AML compliance service designed to ease ultimate beneficiary ownership (UBO) discovery for regulated entities across the world. Achieving full insight into cross-border shareholder structures ranks as the most difficult and time-consuming challenge for compliance teams. Now time spent on this AML compliance requirement can be significantly reduced.

With a longstanding history of making the traditionally inaccessible, accessible, kompany has developed its latest product to simplify the search and discovery process of shareholders through its application of category-leading artificial intelligence and machine learning technology.

“Shareholder information mainly consists of unstructured data, often hidden in pdfs, with little to no consistency in how it’s collected, recorded or stored.” describes kompany CEO and Founder Russell E. Perry. Compliance teams are tasked with wading through PDFs, often composed of inconsistently designed forms and even low-quality scans. Even within the same register, different regional bodies can submit the filings in a variety of ways. A new and innovative method was required to resolve the challenges posed by this paper-dominated and inconsistent approach.

“Shareholder information mainly consists of unstructured data, often hidden in pdfs, with little to no consistency in how it’s collected, recorded or stored.” describes kompany CEO and Founder Russell E. Perry. Compliance teams are tasked with wading through PDFs, often composed of inconsistently designed forms and even low-quality scans. Even within the same register, different regional bodies can submit the filings in a variety of ways. A new and innovative method was required to resolve the challenges posed by this paper-dominated and inconsistent approach.

There are two particularly unique features of UBO discovery, the first of which includes the ability to break down jurisdictional barriers to display cross-border ownership information in real-time and on-demand. The second significant feature includes the intuitive visualisation of the ownership structure, which presents complex shareholder networks in an easy-to-read format.

“An estimated 80% of all company information in registers around the world is only available as unstructured data. Essential company data is often locked away in PDFs. As the costs and risks of non-compliance increase, the market is very much craving a solution like UBO discovery to enable smarter, faster and complete compliance” added Perry, “Our goal is to maintain our reputation as an industry leader in RegTech and stay ahead of the regulatory burden through technology.”

kompany is proud to transform the due diligence experience for its clients around the world by giving them the latest tools and technology to stay compliant now and into the future.

About kompany

kompany is the leading RegTech platform for Global Business Verification and Business KYC (KYB) for AML compliance. Its advanced API platform and collaborative web-based KYC workspace provide financial institutions, payment providers, insurers and other regulated corporations the automation platform and tools required for Business KYC (KYB) and audit-proof business verification for anti-money-laundering compliance. Clients include global and international banking groups, FinTechs, Big Four accounting firms, law firms, Banking-as-a-Service and compliance platforms, as well as multinational corporations.

kompany is an alumnus of Mastercard Startpath, Plug and Play FinTech, Raiffeisen Bank International’s Elevator Lab, the Oracle Scale Up programme and founding member of the International RegTech Association and the Austrian Blockchain Association.

It is headquartered in Vienna, Austria with offices in London, New York, and Singapore. kompany is a government licensed clearing house and official distributor for commercial and business registers in many countries worldwide. Find out more at kompany.com, or follow on LinkedIn.

It is headquartered in Vienna, Austria with offices in London, New York, and Singapore. kompany is a government licensed clearing house and official distributor for commercial and business registers in many countries worldwide. Find out more at kompany.com, or follow on LinkedIn.

Source: kompany

kompany is a member of BIIA