In spite of the current difficult economic situation in Russia, corporations continue to be profitable, according to statistics released by the Federal State Statistics Service of Russia (Rosstat).

In spite of the current difficult economic situation in Russia, corporations continue to be profitable, according to statistics released by the Federal State Statistics Service of Russia (Rosstat).

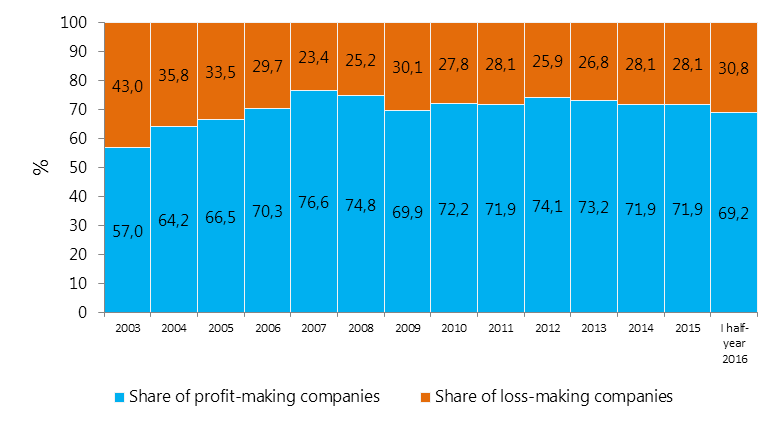

In examining the company results for the first half of 2016, 69% of companies in Russia were profitable. In comparison with the same period of 2015, the increase in income was marginal: 0.4 percentage points (p.p.).

For 2015, the number of profit and loss-making companies stayed at the same level – 71.9% and 28.1% respectively. As a rule of thumb it should be noted that the number of profitable companies are higher for the whole financial year than for the first half-year.

The number of profit-making companies in 2003 was at a considerably lower level (57%) than today (69.2%). At that time the Russian economy was more vulnerable, although there was no serious geopolitical confrontation such as the current imposed sanctions which negatively impacts the Russian business community. Considering the current economic difficulties and the improved profitability during the past 10 years provide an indication that prospects for millions of Russian companies to operate profitably are real.

Chart 1: Share of profit- and loss-making companies in Russia of total number of companies in %

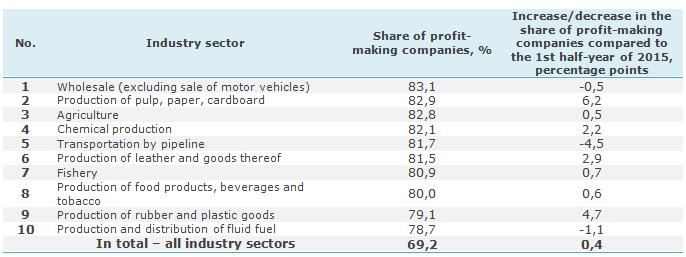

The following charts provide an overview of economic sectors in terms of how many companies are profitable or un-profitable in a given sector and whether there was an improvement or deterioration in profitability. For example: Pulp and paper sector as well as production of rubber and plastic goods showed the highest growth in profitability as compared to the 1st half of 2015. The share of profitable companies in these sectors is considerably higher than the average shown in chart 1. The wholesale sector’s share of 83.1% in profitable businesses tops the list (chart 2).

Chart 2: Share of profit-making companies by sectors of the economy for the first half-year of 2016, Top-10 of sectors

In the first half of 2016 30, 8% of total number of companies in Russia sustained losses (see chart 3), however this indicator is lower than in the same period of 2015, when 31.2% of loss-making companies were recorded.

Comparing the actual data for 2015 with the data in 2003, the general trend is positive: the number of loss-making companies for the past 12 years was reduced from 43% to 28.1% or by 14.9 p.p. In essence the ratio of non-profitable companies was 1 to 3 in 2015 compared to 1 to 2 in 2013.

The largest share of loss-making companies were in transportation and housing and communal services, as well as in hospitality industry sectors. These sectors are traditionally supported by the state and a decrease in demand causes a commensurate decrease in real income (see chart 3).

Chart 3: Share of loss-making companies by sectors of the economy for the first half-year of 2016, Top-10 of sectors

For potential investors it is comforting to note, that in terms of profitability, there is evidence of stability in spite of the current negative external economic climate. The situation is not catastrophic. It is anticipated that a large part of foreign investors realize that there are good investment opportunities in sectors not related to oil and gas extraction and distribution. Here are some salient points:

- Last year, after almost a century, Russia took back the status of being the leading grain (including wheat) supplier (30.7 mln tons in 2015) and leaving acknowledged market leaders such as Canada, the USA and France behind.

- Russian armaments are in high demand in many countries which are not NATO-members. Russia has been for some time the second largest supplier behind the USA.

- Russia’s Internet industry (content and services) accounted to over 20.850 bn USD in 2015. Alone the market of electronic payment sector showed the volume of 9 bn USD which is an equivalent to 2.4% of the GDP. In monetary terms, so called “Internet-dependent markets” are equitable to 19% of the GDP. Compared to traditional manufacturing, this sector is growing at a rapid pace. Well-known Russian IT-industry companies such as “Yandex”, “Kaspersky Lab”, “1C”, “Lanit” have successfully entered the global market.

- “Uralkali” company is the world’s largest manufacturer of potassium fertilizers.

- “Corporation ROSATOM” implements the energetic projects of immense complexity for the nuclear industry formation in Iran and Turkey from the ground up.

It is worthwhile noting that Russia managed to create a diversified economy providing a further prospects profitable investment.

Source: The Federal State Statistics Service of Russia (Rosstat)

Source: The Federal State Statistics Service of Russia (Rosstat)